Activision Blizzard

ATVI

, a Zacks Rank #5 (Strong Sell), resides in the Zacks Toys – Games – Hobbies Industry, which currently ranks in the bottom 25% of all Zacks Industries. Due to its unfavorable Zacks Industry ranking, we expect it to underperform the market over the next three to six months.

Activision Blizzard is a leader in video game development and an interactive entertainment content publisher, most well-known for

Call of Duty

.

Currently, the company operates five business units: Activision Publishing, Blizzard Entertainment, Major League Gaming, King, and Activision Blizzard Studios.

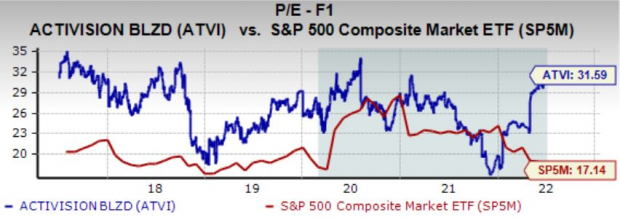

Share Performance

Over the last year, ATVI shares have struggled immensely, declining approximately 16% in value and underperforming the S&P 500 by a wide margin.

Image Source: Zacks Investment Research

As we can see, there was a sharp move upward in January due to the news of Microsoft acquiring the company.

Quarterly Performance & Valuation

The company has recently struggled, reporting top and bottom-line results under expectations in its latest two earnings releases. Regarding the bottom-line, ATVI reported quarterly EPS of $0.38 in its latest quarter, missing the Zacks Consensus Estimate of $0.73 by a concerning 48%.

In fact, the average EPS surprise over the last four quarters has been -7.7%.

Pivoting to the top-line, quarterly sales results of $1.5 billion in its latest quarter missed the $1.8 billion estimate by nearly 18%. It was the company’s second consecutive revenue miss, with the other one also being in the double-digits at 11%.

ATVI’s valuation levels appear a bit stretched, further displayed by its Style Score of a D for Value. Its 31.6X forward earnings multiple is undoubtedly pricey and is well above its five-year median value of 27.1X.

Additionally, the value represents a steep 84% premium relative to the S&P 500’s forward P/E ratio of 17.1X.

Image Source: Zacks Investment Research

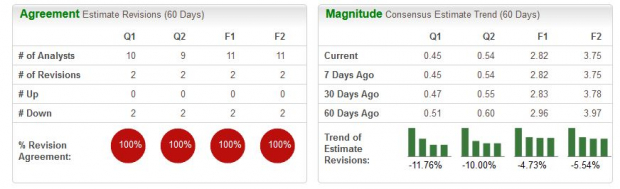

Growth Estimates

Analysts have extensively dialed back their earnings estimates over the last 60 days with a 100% revision agreement percentage. For the upcoming quarter, the $0.45 per share estimate reflects a disheartening 50% decrease in earnings from the year-ago quarter.

Additionally, the $2.82 per share estimate for the current fiscal year represents a nasty 25% decline in earnings year-over-year.

Image Source: Zacks Investment Research

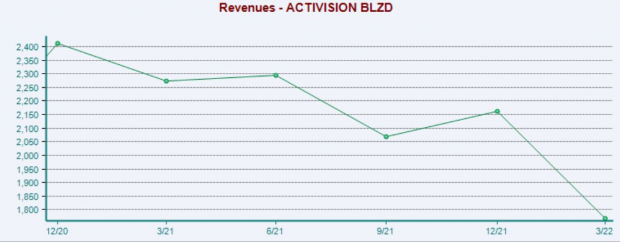

Top-line projections show softening as well. For the upcoming quarter, the Zacks Consensus Sales Estimate of $1.5 billion reflects a 21% decrease from year-ago quarterly sales of $1.9 billion.

Furthermore, the $7.8 billion FY22 revenue estimate represents a 7% decline in revenue year-over-year.

Image Source: Zacks Investment Research

Bottom Line

ATVI shares have been the victim of a double-digit valuation slash over the last year. This, paired with the earnings picture softening, paints a grim picture for the company within the short term.

The company is a Zacks Rank #5 (Strong Sell) and a stock that investors will be better off staying away from for now.

Instead, investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – the odds of reaping considerable gains are much higher within the companies that carry these ranks.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report