Shares of

Biogen

BIIB

were down 4.3% following

reports

of the death of a 65-year-old woman who was administered its anti-amyloid beta protofibril antibody candidate lecanemab in clinical studies which increases concerns over the drug’s safety. The candidate is being developed in collaboration with Eisai, who is leading clinical development.

Per the article, the woman died from a massive brain hemorrhage which some researchers believe happened due to lecanemab administration. This is the second death linked to the drug that has been reported this year. In June, a news

article

reported the death of a man in his 80s, also from a brain hemorrhage, who also participated in lecanemab clinical studies.

However, Eisai has issued a statement stating that these deaths are not linked to lecanemab administration. Eisai is also set to present detailed results from Clarity AD, the late-stage confirmatory study evaluating lecanemab in AD patients, later this week.

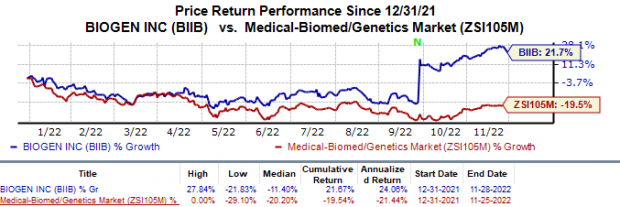

Biogen’s shares have surged 21.7% so far this year against the

industry

’s 19.5% decline.

Image Source: Zacks Investment Research

Biogen has developed lecanemab in collaboration with Eisai, with the latter also responsible for leading lecanemab’s regulatory submissions. This July, the FDA accepted the biologics license application (“BLA”) seeking accelerated approval for lecanemab to treat early AD and granted priority review to the BLA filing. A final decision is expected by Jan 6, 2023.

In September, Biogen and partner Eisai announced positive top-line data from Clarity AD study, which showed that treatment with lecanemab exhibited statistically significant reduction of clinical decline in AD patients. The study met the primary endpoint as well as all key secondary endpoints.

If approved by the FDA, the drug will be the only anti-amyloid beta antibody that can be used to treat early AD without the need for titration.

In June last year, the FDA approved Biogen and Eisai’s controversial AD drug, Aduhelm. However, the launch failed after Medicare limited coverage for Aduhelm only for patients enrolled in CMS-approved studies as its efficacy was under question.

Earlier this month,

Roche

RHHBY

announced the failure of the GRADUATE I and II studies, evaluating its monoclonal antibody gantenerumab in early AD. The studies failed to meet their primary endpoint of slowing clinical decline. Patients treated with Roche’s gantenerumab showed a slowdown of clinical decline in GRADUATE I and GRADUATE II, which was not statistically significant.

Nevertheless, despite the complexities associated with developing a treatment for AD and past failures, the space will continue to attract attention from pharma and biotech companies, given the significant unmet need. Many companies like

Eli Lilly

LLY

and

Prothena

PRTA

are also developing their antibody candidates targeting the AD indication.

Eli Lilly has developed donanemab, an investigational antibody therapy, for AD. Eli Lilly initiated a rolling submission with the FDA last year, seeking approval for donanemab under the accelerated pathway based on data from the phase II TRAILBLAZER-ALZ study. A final decision on the BLA is expected in early 2023. Lilly also expects a data readout from the phase III TRAILBLAZER-ALZ 2 by mid-2023. If positive, the data will form the basis of its application for traditional regulatory approval for donanemab.

Prothena is evaluating multiple AD candidates in early-stage studies targeting AD indication. Prothena is evaluating PRX005, an investigational antibody that targets tau, a protein implicated in diseases including AD, frontotemporal dementia, progressive supranuclear palsy, chronic traumatic encephalopathy and other tauopathies. Data from the study is expected by year-end.

Prothena also plans to start a phase I study by year-end evaluating PRX012, an investigational high-potency monoclonal antibody targeting a key epitope at the N-terminus of amyloid beta (Aβ) for treating AD. PRTA also plans to initiate an IND filing for PRX123, a dual Aβ-Tau vaccine treatment and prevention therapy for AD, in 2023.

Zacks Rank

Biogen currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report