Biogen

BIIB

and partner

Sage Therapeutics

SAGE

completed the rolling submission of the new drug application (NDA) to the FDA for zuranolone for the potential treatment of major depressive disorder (MDD) and postpartum depression (PPD). The NDA submission for this 14-day short course, rapid-acting, oral investigational drug was initiated in May.

The NDA included data from two development programs — LANDSCAPE and NEST. Clinical data on zuranolone demonstrated that the candidate achieved consistent, rapid, and sustained reductions in depressive symptoms with a good safety profile. The LANDSCAPE program includes five studies of zuranolone in adults with MDD, while the NEST program comprised two studies in adult women with PPD

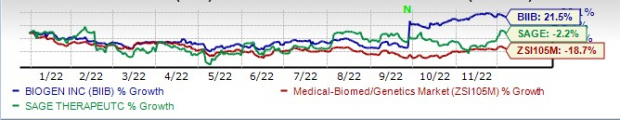

Biogen’s stock has risen 21.4%, while Sage Therapeutics’ stock has declined 2.2% this year so far. The

industry

has declined 18.7% in the said time frame.

Image Source: Zacks Investment Research

The depression medicines available presently take a lot of time, sometimes weeks and months to provide relief from symptoms. Biogen/Sage believe zuranolone, if approved, can change the way depression is treated as it has a novel mechanism of action, which may help to rapidly rebalance dysregulated neuronal networks and improve brain function.

We note that Sage and Biogen entered into a global collaboration and license agreement for developing and commercializing potential breakthrough therapies in depression and movement disorders in November 2020. The agreement included the development of two candidates from Sage Therapeutics’ pipeline — zuranolone and SAGE-324. The mid-stage candidate, SAGE-324, is being developed for treating essential tremors.

Zacks Rank & Key Picks

Biogen has a Zacks Rank #2 (Buy) currently while Sage has a Zacks Rank of 3 (Hold).

Some large biotech stocks worth considering are

Vertex Pharmaceuticals

VRTX

and

Gilead Sciences

GILD

, both carrying a Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex Pharmaceuticals’ stock has risen 41.9% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.21 to $14.65 per share, while that for 2023 have increased from $15.09 to $15.62 per share over the past 60 days. Vertex has a four-quarter earnings surprise of 3.16%, on average.

Estimates for Gilead’s 2022 earnings per share have increased from $6.61 per share to $7.09 per share, while that for 2023 have increased from $6.49 per share to $6.80 per share in the past 30 days. Gilead’s stock is up 21.1% in the year-to-date period.

Gilead beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 0.36%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report