Biogen

BIIB

announced that the European Medicines Agency (EMA) has accepted the marketing authorization application seeking approval of antisense drug, tofersen in patients with amyotrophic lateral sclerosis (“ALS”) with superoxide dismutase 1 (“SOD1”) mutation.

ALS is a rare neurodegenerative disease whose progression leads to a steady decline in the ability to move, speak, eat and eventually breathe. The average life expectancy of people with this often-fatal disease ranges from three to five years. SOD1-mutated ALS is a genetic form of ALS that currently accounts for 2% of the ALS population. There is currently no treatment available for SOD1-ALS. If approved, tofersen will be the first genetically-targeted treatment for SOD1-ALS in Europe. SOD1-ALS affects less than 1,000 people in Europe

Biogen’s new drug application (NDA) for tofersen is under review with the FDA. In October, the FDA extended the review period for the NDA. Following the extension of the NDA review, a final decision from the FDA is expected by Apr 25, 2023. Prior to the extension, the FDA had originally set a target action date of January 2023.

Biogen’s regulatory filings for tofersen were supported by data from the phase III VALOR study, its open-label extension (OLE) study and a couple of early-stage studies.

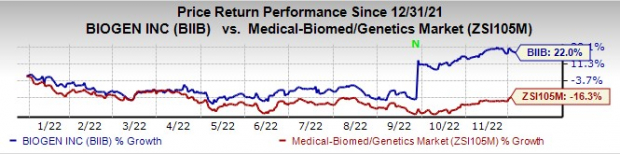

Biogen’s stock has risen 22% this year so far against a decline of 16.3% for the

industry

.

Image Source: Zacks Investment Research

Though the VALOR study did not achieve statistical significance in primary endpoints, data from the same demonstrated that patients who started tofersen earlier reported signs of reduced disease progression across multiple measures. The signs included a reduction in SOD1 protein, a drop in neurofilament and an improvement in respiratory function compared with a placebo.

Data from the VALOR study also showed that compared with the delayed initiation of treatment, the earlier initiation of treatment with tofersen showed clinical benefit in study participants. An earlier start of treatment with tofersen led to a slowed decline in clinical function, respiratory function, muscle strength and quality of life.

Biogen in-licensed rights to tofersen from

Ionis Pharmaceuticals

IONS

under a collaborative development and license agreement entered in 2018. Apart from tofersen, Biogen is also collaborating with Ionis to develop ION541 for ALS (phase II) and ION859 for Parkinson’s disease (phase I/II).

Biogen and Ionis already have an existing marketed drug, Spinraza, which has now become the standard-of-care treatment for treating spinal muscular atrophy (SMA). While Biogen is responsible for Spinraza’s sales, Ionis receives royalties on the same.

Zacks Rank & Stocks to Consider

Biogen has a Zacks Rank #2 (Buy) currently. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some other large biotech stocks worth considering are

Vertex Pharmaceuticals

VRTX

and

Gilead Sciences

GILD

, all carrying a Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex Pharmaceuticals’ stock has risen 44.6% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.21 to $14.61 per share, while that for 2023 have increased from $15.09 to $15.60 per share over the past 60 days. Vertex has a four-quarter earnings surprise of 3.16%, on average.

Estimates for Gilead’s 2022 earnings per share have increased from $6.61 per share to $7.09 per share, while that for 2023 have increased from $6.30 per share to $6.80 per share in the past 30 days. Gilead’s stock is up 21.1% in the year-to-date period.

Gilead beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 0.36%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report