BioMarin

BMRN

announced that the European Medicines Agency (“EMA”) validated its Type II Variation application, seeking label expansion for Voxzogo (vosoritide) injection to treat children aged under two years with achondroplasia.

Voxzogo is currently approved in the European Union for treating achondroplasia in children aged two years and older with open growth plates.

The regulatory filing is based on data from a phase II study that evaluated the safety and efficacy of Voxzogo in infants and children aged three months to less than five years. In February 2022, BioMarin announced top-line data from this study. The 52-week results trended in favor of Voxzogo compared with the placebo on height Z-score (which measures height adjusted for age and sex), annualized growth velocity and no worsening of proportionality in the overall study population.

BioMarin also announced that it submitted a supplemental New Drug Application (sNDA) to the FDA to treat children under five years with achondroplasia. The regulatory agency approved the drug to treat achondroplasia in individuals aged five years and above with open epiphyses (bone growth plates).

If Voxzogo is approved for use in these two age groups in the United States and Europe, more than a thousand children suffering from achondroplasia will be eligible for treatment with the drug.

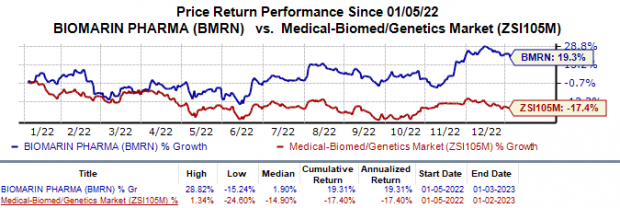

Shares of BioMarin have gained 19.3% in the past year against the

industry

’s 17.4% fall.

Image Source: Zacks Investment Research

Voxzogo was approved in Europe in August 2021 and United States in November 2021 to treat achondroplasia, the most common form of dwarfism. Following its approval, Voxzogo became the first medicine to treat this indication.

Since its launch, Voxzogo has seen rapid uptake driven by strong prescription demand. BioMarin is seeking approvals for the drug across multiple new markets, which can boost sales for the drug. In the first nine months of 2022, Voxzogo generated sales worth $102 million, mainly driven by new patient initiations, which is encouraging for a newly launched drug. For the full year, management expects Voxzogo sales to peak at $170 million.

BioMarin is currently focused on introducing new gene therapy treatments in its portfolio. The newest drug in BioMarin’s portfolio is Roctavian (valoctocogene roxaparvovec or valrox), gene therapy for severe hemophilia A, which received conditional marketing authorization in the European Union in August 2022.

In September 2022, management completed the refiling of the biologics license application (BLA) to the FDA, seeking approval for valrox gene therapy to treat adult patients with severe hemophilia A. BioMarin previously submitted a BLA in 2019 for valrox to address hemophilia A. However, the FDA issued a complete response letter (CRL) to the BLA in 2020, citing dissatisfaction with the available data. While a final decision is expected by March 2023-end, management expects the FDA to further extend this review by another three months following the submission of three-year follow-up safety and efficacy data.

Zacks Rank & Stocks to Consider

BioMarin currently carries a Zacks Rank #3 (Hold).Some better-ranked stocks in the overall healthcare sector include

Allogene

ALLO

,

Amarin Corporation

AMRN

and

AVEO Pharmaceuticals

AVEO

, each carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

In the past 60 days, estimates for Allogene’s 2022 loss per share have narrowed from $2.40 to $2.38. During the same period, the loss estimates per share for 2023 have narrowed from $2.87 to $2.82. Shares of Allogene have declined 58.1% in the past one-year period.

The earnings of Allogene beat estimates in each of the last four quarters, witnessing an earnings surprise of 9.44%, on average. In the last reported quarter, Allogene’s earnings beat estimates by 6.45%.

In the past 60 days, estimates for Amarin’s 2022 loss per share have narrowed from 15 cents to 13 cents. Shares of Amarin have declined 63.5% in the past year.

Earnings of Amarin beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing a negative earnings surprise of 14.29%, on average. In the last reported quarter, Amarin’s earnings beat estimates by 200.00%.

In the past 60 days, estimates for AVEO Pharmaceuticals’ 2022 loss per share have narrowed from 76 cents to 68 cents. During the same period, the earnings estimates per share for 2023 have risen from 46 cents to 52 cents. Shares of AVEO Pharmaceuticals have surged 233.9% in the past one-year period.

Earnings of AVEO Pharmaceuticals beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 19.87%, on average. In the last reported quarter, AVEO Pharmaceuticals’ earnings beat estimates by 43.75%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report