BioNTech SE

BNTX

announced that has it entered into a collaboration with Poland-based drug discovery company, Ryvu Therapeutics S.A., for developing small molecule programs targeting immune modulation in cancer as well as other diseases.

The multi-target research collaboration will comprise two parts. Firstly, drug discovery and research projects will be carried out jointly by both companies to develop multiple small molecule programs based on targets exclusively selected by BioNTech, which will mainly target immune modulation in cancer and some other diseases.

Additionally, BNTX will receive an exclusive license to develop and commercialize Ryvu’s STING agonist portfolio as standalone small molecules, both as monotherapy and in combination therapy.

BioNTech will also have the option to license global development and commercialization rights of these programs at any given stage during the course of their collaboration.

Per the terms of the agreement, BNTX will make an upfront payment of €20 million to Ryvu for getting certain rights to the latter’s STING agonist portfolio, as well as certain rights and options to license multiple small molecule programs.

BioNTech has also decided to make an equity investment of €20 million in Ryvu.

BNTX will be solely responsible for funding all drug discovery, research and development activities, while Ryvu is entitled to receive certain regulatory and sales-based milestone payments.

Ryvu is also eligible to receive low single-digit royalties on the net sales if a product is successfully developed and commercialized from the above collaboration.

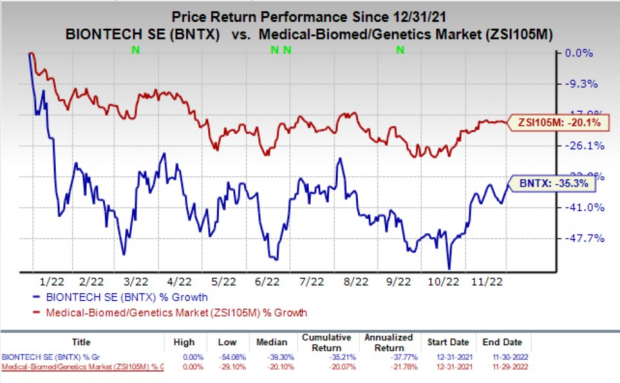

Shares of BioNTech were up 2.1% on Wednesday following the announcement of the news. The stock has declined 35.3% so far this year compared with the

industry

’s decline of 20.1%.

Image Source: Zacks Investment Research

We note that one of Ryvu’s most advanced candidates, RVU120, a selective CDK8/CDK19 kinase inhibitor, is currently being evaluated in early-to-mid-stage studies for treating various hematological malignancies and solid tumors.

A phase I study is evaluating RVU120 for treating acute myeloid leukemia and myelodysplastic syndrome, while another phase I/II study is investigating RVU120 for the treatment of r/r metastatic or advanced solid tumors.

Ryvu’s another candidate, SEL24 (MEN1703), a dual PIM/FLT3 kinase inhibitor, is currently being evaluated in phase II studies for treating acute myeloid leukemia.

Such deals are likely to complement BioNTech’s impressive pipeline that boasts several cancer candidates, such as BNT111, the company’s mRNA-based FixVac cancer vaccine program, as well as BNT113, BNT122, BNT211 and BNT311, which are in early to mid-stage studies for various oncological indications.

Zacks Rank & Stocks to Consider

BioNTech currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

ASLAN Pharmaceuticals Limited

ASLN

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Immunocore Holdings plc

IMCR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Aeglea BioTherapeutics have narrowed 7.3% for 2022 and 13.2% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. AGLE witnessed an earnings surprise of 3.60% on average.

Loss per share estimates for Immunocore have narrowed 39.7% for 2022 and 39.4% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report