BioNTech SE

BNTX

is scheduled to report fourth-quarter and full-year 2021 results on Mar 30, before market opens.

The company’s earnings surprise record has been excellent so far as its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 132.44%. In the last-reported quarter, BioNTech delivered an earnings surprise of 23.49%.

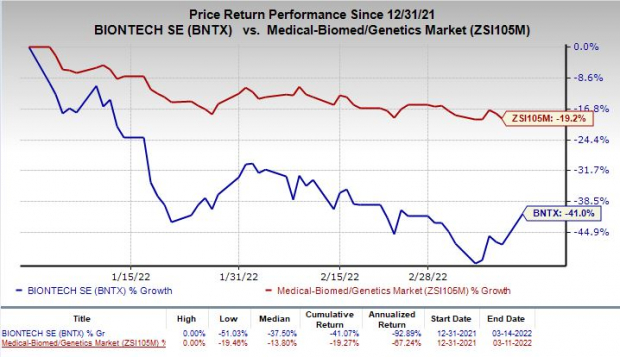

Shares of BioNTech have plunged 41% so far this year compared with the

industry

’s decrease of 19.2%.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the quarter to be reported.

Factors at Play

The major contributor to BioNTech’s sales in the fourth quarter is likely to have been the COVID-19 vaccine called Comirnaty, which it has developed with its partner,

Pfizer

PFE

. The vaccine is now approved for emergency use in several countries and has become a key contributor to BioNTech’s top line.

Revenues in the to-be-reported quarter are likely to have been driven by Comirnaty owing to rapid increases in supply and sales of the COVID-19 vaccine worldwide.

During the fourth quarter, the FDA extended the Emergency Use Authorization for the booster dose of Pfizer/BioNTech’s COVID-19 vaccine to allow its use in all adults as well as children from 12 through 17 years of age. The FDA also granted emergency approval to the COVID-19 vaccine for children from five through 11 years of age, making it the first vaccine authorized in the United States for this age group.

Per a Pfizer press release, more than three billion doses of Comirnaty were manufactured in 2021 while four billion doses of the same are expected to be manufactured by the end of 2022.

BioNTech/Pfizer are also working on an Omicron-specific vaccine candidate and a bivalent COVID-19 vaccine candidate.

We expect management to provide more updates on the same at the upcoming earnings call.

Along with BioNTech and Pfizer, another biotech giant,

Moderna

MRNA

, played a key role in combating the COVID-19 pandemic to a great extent by developing vaccines in record time.

Moderna’s COVID-19 vaccine, Spikevax, is authorized for use in adolescents and adults in several countries. Moreover, the booster or third dose of the vaccine also received the FDA’s approval for emergency use in adults.

MRNA is also evaluating its Omicron-specific booster candidate in a mid-stage study in the United States.

BioNTech’s pipeline boasts of several candidates, such as BNT111, the company’s mRNA-based FixVac cancer vaccine program, along with BNT113, BNT122, BNT211 and BNT311, to name a few that are in early- to mid-stage studies for various oncological indications. Updates on the above-mentioned programs are expected during the upcoming earnings call.

Developmental activities related to the company’s pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for BioNTech this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

BioNTech has an Earnings ESP of -2.12% as the Zacks Consensus Estimate stands at $8.12 per share while the Most Accurate Estimate is pegged at $7.95 per share.

Zacks Rank:

BioNTech has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

A Stock to Consider

Here is a biotech stock that has the right combination of elements to beat on earnings this time around:

NuCana plc

NCNA

has an Earnings ESP of of +28.00% and a Zacks Rank #2, currently.

NuCana’s earnings topped estimates in one of the last four quarters. NCNA has a negative four-quarter earnings surprise of 13.64%, on average.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report