Biotechnology stocks can be high-risk investments because of the intensive research and development (R&D) process necessary for developing new drugs. Even with the millions of dollars that are often spent, there is never a guarantee that the drug will pass regulatory hurdles from the Federal Drug Administration (FDA) or that the drug will ever reach the market.

There are many reasons why biotech companies are often unprofitable for years, including:

·

High R&D costs:

R&D in the biotech field is expensive and time-consuming.

·

Regulatory Approval:

The process may take years to complete before a drug can be sold (assuming its approved).

·

Competition:

The biotech industry can be highly competitive because the rewards are so high if a drug is approved. Several companies often work on a solution to the same health problem – something that is good for consumers but can be tough for biotech companies.

Below, we will cover profitable biotech companies that are worth watching.

Gilead Sciences

GILD

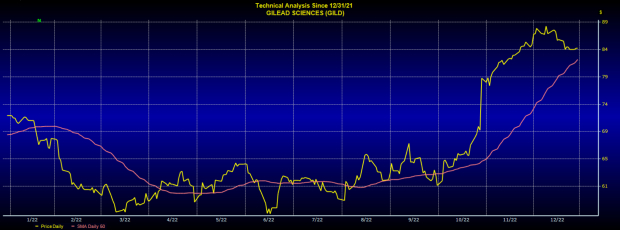

is a drugmaker that develops treatments for HIV, Hepatitis C, and other diseases. Until recently, the $107 billion giant had been stuck in a long, frustrating price range however, recently, it finally pulled back after a 9-week winning streak.

Image Source: Zacks Investment Research

Pictured: Gilead shares have been on a tear since reporting strong profits from it’s cancer drugs.

What woke the stock up? In Gilead’s third quarter earnings report, sales of the company’s cancer drugs almost doubled. On an annual basis, sales of its two major cancer drugs rocketed by more than 75%. Though sales growth has slowed in recent quarters, the company raised revenue guidance.

Image Source: Zacks Investment Research

Pictured: Gild’s P/E is attractive on a relative basis when compared to the general market.

If Gilead’s cancer drugs can propel the company to higher growth, the stock will be attractive from both a growth and a valuation perspective. GILD’s P/E over the trailing twelve months stands at an attractive 13.52 compared to the S&P 500 Index’s 18.06 – scoring the biotech giant the highest possible Zack’s Value Ranking of A. Though the stock has only caught fire recently, its price history over time suggests the company is worth watching. Despite its size, GILD is up 1,900% over the past 20 years – far outpacing the general market’s performance.

Image Source: Zacks Investment Research

Pictured: GILD is a top performing stock over the past 20 years. Can the biotech behemoth reward investors once again?

Catalyst Pharmaceuticals

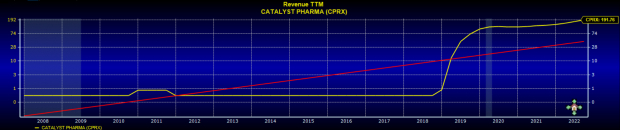

CPRX

is a developer of therapies that target rare neurological diseases and disorders such as Tourette Syndrome and Lambert-Eaton Myasthenic Syndrome (LEMS). Over the past three quarters CPRX has achieved impressive EPS growth of +64%, +75%, and +86% on revenue growth of +43%, +46%, and +59%.

Image Source: Zacks Investment Research

Pictured: CPRX revenue is firing on all cylinders.

CPRX’s financial efficiency has also drastically improved over the past 12 months. The company boasts a healthy return on equity (ROE) of 28.53 – a rare high number in the biotech industry.

Image Source: Zacks Investment Research

Pictured: CPRX is very financially efficient – especially for a biotech.

Catalyst’s stock has responded. The stock is up by 150% on the year and recently found buyers at its rising 50-day moving average. Investors should stick with the trend as long as shares hold the 50-day moving average.

Moderna Inc

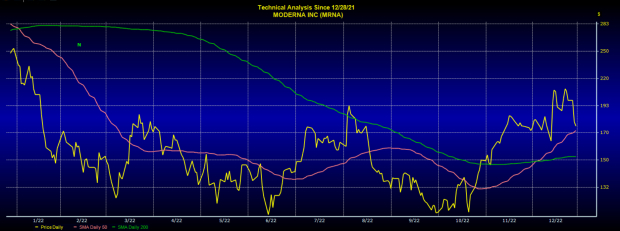

MRNA

is a developer of the MRNA-based COVID-19 vaccine Spikevax, which was approved in the United States. The vaccine is also authorized for emergency use in several countries worldwide. Before the rollout of its Coronavirus vaccine, Moderna had been unprofitable. In 2021, Moderna swung to annual EPS of 28.21 from a loss of -1.96 in 2020.

While Moderna’s windfall profits have slowed slightly, the company is still very profitable and is getting more attractive on a valuation basis. MRNA holds a P/E ratio of just 6.52 currently. Moderna sports a Zack’s Momentum and Value Ranking of A.

Image Source: Zacks Investment Research

Pictured: MRNA’s technical picture is improving as the stock retakes its key moving averages.

From a technical perspective, MRNA’s chart is improving. The stock recently retook its 200-day moving average and is pulling into its rising 50-day moving average – an area of attractive risk-to-reward.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report