It was a busy week for the biotech sector, with many important pipeline and regulatory updates.

Madrigal Pharmaceuticals, Inc

MDGL

soared significantly on positive results from its NASH study, which also boosted shares of other companies that have candidates in their pipeline for NASH. Other pipeline updates were also in focus.

Recap of the Week’s Most Important Stories

:

Madrigal Surges on NASH Data

: Shares of clinical-stage biopharmaceutical company Madrigal

skyrocketed

after the company announced positive top-line results from the phase III MAESTRO-NASH biopsy clinical trial of resmetirom, a liver-directed selective thyroid hormone receptor agonist. In MAESTRO-NASH, a 52-week serial liver biopsy phase III study in more than 950 patients, resmetirom achieved both primary endpoints and potentially clinically meaningful effects with both daily oral doses, 80 mg and 100 mg, relative to placebo.

The study achieved both liver histological improvement endpoints as proposed by the FDA, which is likely to predict clinical benefit to support accelerated approval of resmetirom for treating NASH with liver fibrosis. Treatment with resmetirom also demonstrated potentially clinically meaningful LDL reduction, a key secondary endpoint of the above-mentioned study. Treatment with resmetirom was safe and well-tolerated. Madrigal intends to file a new drug application seeking accelerated approval of resmetirom for treating non-cirrhotic NASH with liver fibrosis.

Madrigal currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Entrada Down on Regulatory Update for DMD Candidate

: Shares of

Entrada Therapeutics, Inc.

TRDA

were

down

after the company announced that it received a clinical hold notice from the FDA regarding its Investigational New Drug Application (IND) for ENTR-601-44 for the potential treatment of Duchenne muscular dystrophy (DMD). The regulatory body indicated it will provide an official clinical hold letter to Entrada within 30 days. TRDA plans to share additional updates pending further communications with the agency. The company’s lead oligonucleotide programs include ENTR-601-44, targeting DMD and ENTR-701 targeting myotonic dystrophy type 1 (DM1). The clinical hold was disappointing as ENTR-601-44 is one of the lead programs of the company and will delay the development of the candidate.

bluebird’s Regulatory Update

:

bluebird bio

BLUE

announced that the FDA lifted its partial clinical hold for patients under the age of 18 in studies evaluating lovotibeglogene autotemcel (lovo-cel) for sickle cell disease (SCD). bluebird plans to resume enrollment and treatment of pediatric and adolescent patients in the first quarter of next year. The studies were put on partial hold for these patients in December 2021 following an investigation by bluebird bio into an adolescent patient with persistent, non-transfusion-dependent anemia following treatment with lovo-cel.

bluebird recently detailed its investigation of this case at the American Society of Hematology Annual Meeting and Exposition alongside details from another case of persistent anemia in an adult patient following treatment with lovo-cel. The company stated that both patients had two α-globin gene deletions (−α3.7/−α3.7), also known as alpha-thalassemia trait, and notably were the only patients in the study with this specific genotype. Following these cases, this genotype was added to the exclusion criteria for ongoing studies.

Meanwhile, enrollment and dosing for adult patients 18 and older in the HGB-210 study continued as planned, while the partial hold was ongoing for patients under the age of 18. bluebird is working to resume enrollment and treatment of patients ages 2-17 consistent with the study protocol. It intends to submit a biologics license application (BLA) to the FDA for lovo-cel in the first quarter of 2023.

Arcus Down on Study Data

: Shares of

Arcus Biosciences Inc

RCUS

were down after the company and partner

Gilead Sciences, Inc

.

GILD

announced results from the fourth interim analysis of the ARC-7 study in patients with first-line, metastatic non-small cell lung cancer (NSCLC) with PD-L1 tumor proportion score (TPS) ≥50% without epidermal growth factor receptor or anaplastic lymphoma kinase (EGFR/ALK) mutations.

The phase II multicenter, three-arm, randomized, open-label study is evaluating the combinations of Fc-silent anti-TIGIT monoclonal antibody domvanalimab plus anti-PD1 monoclonal antibody zimberelimab (doublet) and domvanalimab plus zimberelimab and etrumadenant, an A2a/b adenosine receptor antagonist (triplet), versus zimberelimab monotherapy. Both the doublet and triplet combinations demonstrated clinically meaningful improvements in median progression-free survival (PFS) and six-month landmark PFS rates compared to zimberelimab monotherapy, with a 45% reduction in risk of disease progression or death for the doublet and 35% for the triplet with a median follow-up time for efficacy duration of approximately 12 months.

Each of the domvanalimab-containing study arms also demonstrated clinically meaningful improvements in objective response rate (ORR) compared to zimberelimab monotherapy. Confirmed ORR was 27%, 41% and 40% for the zimberelimab monotherapy arm and the domvanalimab-doublet and -triplet arms, respectively. However, the triplet arm did not show an improvement over the doublet arm. The study will continue to monitor PFS, as well as overall survival, for the triplet arm as these data mature.

These results did not impress investors specifically when compared to pharma giant Roche’s data evaluating drugs using the same mechanisms. Moreover, other established therapies for the indication heighten the competition. Hence, shares of RCUS declined. Gilead’s shares were down too.

Performance

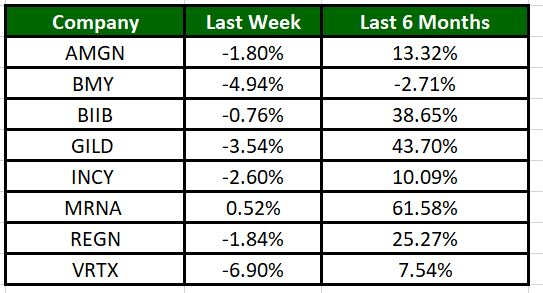

Image Source: Zacks Investment Research

The Nasdaq Biotechnology Index has lost 2.07% in the past five trading sessions. Among the biotech giants, Moderna has gained 0.52% during the period. Over the past six months, shares of Moderna have soared 61.58%. (See the last biotech stock roundup here:

Biotech Stock Roundup: HZNP Surges on AMGN Offer, TRDA Gains on VRTX Deal & More

)

What’s Next in Biotech?

Stay tuned for other updates.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report