Earnings results and other regulatory updates have grabbed focus in the biotech sector this week.

Recap of the Week’s Most Important Stories

:

Moderna’s Q4 Results

:

Moderna

MRNA

beat on earnings and sales in the fourth quarter. The company reported earnings of $11.29 per share, which easily beat the Zacks Consensus Estimate of $9.83. The company had incurred a loss of 69 cents per share in the year-ago quarter. The significant improvement in the bottom line was driven by strong year-over-year growth in revenues.

Revenues in the quarter were $7.2 billion, beating the Zacks Consensus Estimate of $6.71 billion. In the year-ago quarter, revenues were $571 million. The significant increase in the top line was driven by the strong sales of its coronavirus vaccine, which is now approved or authorized for temporary/emergency use in several countries.

Moderna has several advance purchase agreements for its COVID-19 vaccine with multiple countries for 2022, worth $19 billion. These agreements also include an option for the delivery of potential updated COVID-19 vaccine booster candidates aggregating $3 billion.

Moderna carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Gilead Receives CRL for Lenacapavir

:

Gilead Sciences, Inc.

GILD

announced that the FDA has issued a complete response letter (CRL) for the new drug application (NDA) for lenacapavir. The candidate is an investigational, long-acting HIV-1 capsid inhibitor under review for the treatment of HIV-1 infection in heavily treatment-experienced (HTE) people with multi-drug resistant (MDR) HIV-1 infection.

The FDA has cited Chemistry Manufacturing and Controls (CMC) issues relating to the compatibility of lenacapavir with the proposed container vial as the reason for their action. The regulatory body has raised questions about vials made of borosilicate glass and their compatibility with lenacapavir solution, which has resulted in a clinical hold for injectable lenacapavir.

Kodiak Plunges on Study Results

: Shares of

Kodiak Sciences Inc

.

KOD

plummeted after the company announced dismal top-line results from its phase IIb/III study on KSI-301, a novel antibody biopolymer conjugate, in treatment-naïve subjects with neovascular (wet) age-related macular degeneration. The randomized, double-masked, active comparator-controlled study is evaluating the efficacy, durability and safety of KSI-301, a novel antibody biopolymer conjugate, in treatment-naïve subjects with neovascular (wet) age-related macular degeneration.

The results of the study showed that although KSI-301 demonstrated strong durability and was safe and well-tolerated, it did not meet the primary efficacy endpoint of showing non-inferior visual acuity gains for subjects dosed on extended regimens compared to aflibercept given every eight weeks. Investors were clearly disappointed as KSI-301is the lead candidate for Kodiak.

Lexicon Down on Regulatory Update

: Shares of

Lexicon Pharmaceuticals, Inc.

LXRX

plunged after the company announced that it is voluntarily withdrawing its NDA for sotagliflozin. Lexicon had submitted an NDA to the FDA at the end of the fourth quarter of 2021 seeking approval for the marketing and sale of sotagliflozin, to reduce the risk of cardiovascular death, hospitalization for heart failure and urgent visits for heart failure in adult patients with type 2 diabetes with either worsening heart failure or additional risk factors for heart failure irrespective of left ventricular ejection fraction.

The NDA was withdrawn to correct a technical issue with the submission recently identified by the company. Nevertheless, Lexicon plans to resubmit it in the second quarter of 2022.

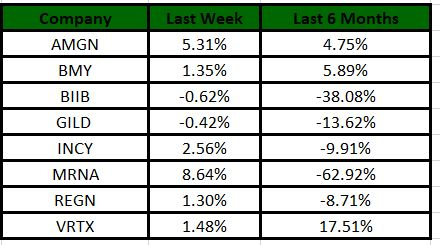

Performance

The Nasdaq Biotechnology Index has gained 3.50% in the past five trading sessions. Among the biotech giants, Moderna has gained 8.64% during the period. Over the past six months, shares of Vertex have soared 17.51%. (See the last biotech stock roundup here:

Biotech Stock Roundup: SAGE, ATRA Down on Study Updates, AGIO Drug Approval & More

)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline and regulatory updates, along with earnings updates.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report