The biotech sector has been in the spotlight in the past week with earnings updates from most of the bigwigs. Other important pipeline and regulatory updates were also in focus.

Recap of the Week’s Most Important Stories

:

Earnings Update From Regeneron, Vertex

:

Regeneron

REGN

posted

better-than-expected first-quarter 2022 results, beating on both earnings and sales driven by strong growth in Eylea and Dupixent. First-quarter earnings of $11.49 per share comfortably beat the Zacks Consensus Estimate of $9.37. Earnings jumped 16% from the year-ago quarter due to higher sales. Total revenues in the reported quarter were up 17% year over year to $2.9 billion and beat the Zacks Consensus Estimate of $2.71 billion. Solid demand for Eylea and Dupixent maintained momentum for the company. However, sales from REGEN-COV took a hit due to the regulatory update. Excluding REGEN-COV (a cocktail of two monoclonal antibodies — casirivimab and imdevimab) for COVID-19, sales increased 25%.

Vertex

’s

VRTX

earnings per share of $3.52

missed

the Zacks Consensus Estimate of $3.60. Nevertheless, the bottom line rose 18% year over year on higher revenues. Strong cystic fibrosis product revenues led to higher earnings in the reported quarter. Revenues of $2.10 billion surpassed the Zacks Consensus Estimate of $2.08 billion. Total product revenues rose 22% year over year, primarily driven by higher sales of Trikafta (marketed as Kaftrio in Europe).

Vertex carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Updates From Intercept

:

Intercept Pharmaceuticals, Inc

.

ICPT

entered into an agreement to sell certain foreign subsidiaries and rights regarding its international operations, including a license to commercialize lead drug Ocaliva (obeticholic acid or OCA) outside of the United States to Advanz Pharma for the indication of primary biliary cholangitis (PBC).

Intercept will receive an upfront payment of $405 million and an additional $45 million from Advanz Pharma contingent upon receipt of an extension of pediatric orphan exclusivity in Europe. Intercept will receive royalties on any future net sales of obeticholic acid in NASH outside of the United States, if Advanz Pharma pursues marketing authorization for this indication in ex-U.S. regions. The company will also continue to be responsible for the manufacturing and supply of obeticholic acid globally. Advanz Pharma will be responsible for packaging, distribution and commercialization of the therapy in all markets outside the United States.

Intercept also announced that the first patient has been dosed in a phase II study evaluating a fixed-dose combination of OCA and bezafibrate (BZF) for the treatment of patients with PBC who have not achieved an adequate biochemical response to ursodeoxycholic acid.

Biohaven Surges on Pfizer Deal

: Shares of

Biohaven Pharmaceutical Holding Company Ltd.

BHVN

surged significantly after Pfizer announced that it will acquire the former for $11.6 billion in cash. Per the terms, Pfizer will acquire all outstanding shares of Biohaven not already owned by it for $148.50 per share in cash. Biohaven common shareholders, including Pfizer, will also receive 0.5 of a share of New Biohaven, a new publicly traded company that will retain the former’s non-CGRP development stage pipeline compounds, per Biohaven common share. The price of $148.50 represents a premium of approximately 33% to Biohaven’s volume-weighted average selling price of $111.70 over the three months prior to the transaction’s announcement.

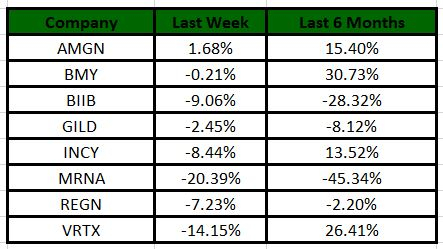

Performance

The Nasdaq Biotechnology Index has lost 13.18% in the past five trading sessions. Among the biotech giants, Moderna has declined 20.39% during the period. Over the past six months, shares of Moderna have lost 45.34%. (See the last biotech stock roundup here:

Biotech Stock Roundup: BIIB & GILD’s Earnings Update, VRTX Down on Regulatory News

)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline and regulatory updates.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report