The biotech sector has been in focus in the past week with a couple of acquisition deals. Other pipeline and regulatory updates also grabbed the spotlight.

Recap of the Week’s Most Important Stories:

Sierra Surges on GSK Deal

: Shares of California-based, late-stage biopharmaceutical company

Sierra Oncology, Inc

SRRA

surged following the announcement of its acquisition by

GlaxoSmithKline

GSK

. Per the terms, GSK will acquire Sierra Oncology for $55 per share of common stock in cash, representing an approximate total equity value of $1.9 billion. The offer price represents a premium of approximately 39% to Sierra Oncology’s closing stock price on Apr 12, 2022. The transaction is expected to close in the third quarter of 2022 or before. The acquisition will add Sierra’s momelotinib being evaluated for myelofibrosis patients with anaemia, to GSK’s pipeline.

Sierra Oncology anticipates regulatory submission in the United States in the second quarter and submission in the EU in the second half of 2022. Momelotinib complements GSK’s Blenrep (belantamab mafodotin) and strengthens its hematology franchise.

Halozyme to Acquire Antares Pharma

:

Halozyme Therapeutics, Inc.

HALO

announced that it will acquire Antares Pharma, Inc. for $5.60 per share in cash or $960 million. The acquisition will add Antares’ commercial portfolio and its auto injector drug delivery technology to Halozyme’s portfolio. The auto injector platform will complement Halozyme’s ENHANZE technology used for developing subcutaneous injections. The transaction is expected to be immediately accretive to Halozyme’s 2022 revenues and earnings. The addition of Antares is also expected to accelerate top-and bottom-line growth and boost cash flow generation through 2027. This transaction is expected to close in the first half of 2022.

Gilead’s Studies Removed From Hold

:

Gilead Sciences, Inc

.

GILD

announced

that the FDA has lifted the partial clinical hold placed on studies evaluating its investigational agent magrolimab in combination with Vidaza.

Magrolimab is being developed in several hematologic cancers, including myelodysplastic syndrome (MDS) and solid tumor malignancies. The FDA placed the hold in January 2022 due to an apparent imbalance in investigator-reported suspected unexpected serious adverse reactions (SUSARs) between study arms. With the hold removed, Gilead can resume enrollment in the studies evaluating magrolimab in combination with Vidaza in MDS and acute myeloid leukemia (AML) in the United States

The company is also planning to re-open enrollment in the magrolimab studies placed on a voluntary hold outside the United States. Gilead is also working with the FDA regarding the remaining partial clinical hold affecting studies evaluating magrolimab in diffuse large B-cell lymphoma and multiple myeloma. The ongoing clinical studies evaluating magrolimab in solid tumors were not subject to the clinical hold.

Gilead currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Ocugen Down on Regulatory Hold

: Shares of

Ocugen, Inc

.

OCGN

were down after the company announced that the FDA placed its phase II/III immuno-bridging and broadening study of its COVID-19 vaccine, Covaxin, on clinical hold.

The decision comes as Ocugen has voluntarily paused dosing in phase II/III OCU-002 study temporarily after inspection of its India-based partner Bharat Biotech’s manufacturing facility by the World Health Organization (“WHO”). WHO identified some deficiencies in good manufacturing practices at the facility. As a result, Bharat Biotech suspended the production of Covaxin for export.

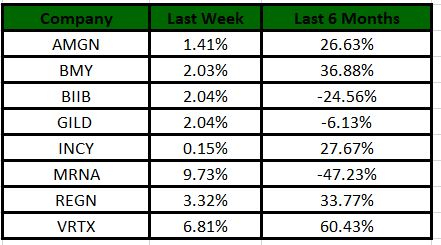

Performance

The Nasdaq Biotechnology Index has gained 0.48% in the past five trading sessions. Among the biotech giants, Vertex has gained 6.81% during the period. Over the past six months, shares of Vertex have lost 60.43%. (See the last biotech stock roundup here:

Biotech Stock Roundup: VIR Down on Regulatory News, BMY Offers Updates & More

).

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline and regulatory updates.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report