Bristol Myers

BMY

announced that it has expanded its strategic alliance with Germany-based

Immatics

IMTX

to develop multiple allogeneic off-the-shelf autologous T cell receptor-based therapy (TCR-T) and/or CAR-T programs for treating cancer indications.

Per the terms of the agreement, both Bristol Myers and Immatics will develop two programs owned by the former. In addition, each company has an option to develop up to four additional programs. These programs will utilize the combination of Immatics’ proprietary platform with Bristol Myers’ next-generation technologies.

IMTX will take charge of the preclinical development of the first two BMY-owned programs. Immatics will be eligible to receive an additional payment for certain activities performed by it on Bristol Myers’ request. BMY will be responsible for the clinical development and commercialization of all programs taken up by it.

In return, Immatics will receive an upfront payment of $60 million and will also be eligible to receive up to $700 million of potential milestone payments for each program undertaken by Bristol Myers. In addition, IMTX will be eligible to receive tiered royalty payments up to low double-digit percentages on net product sales.

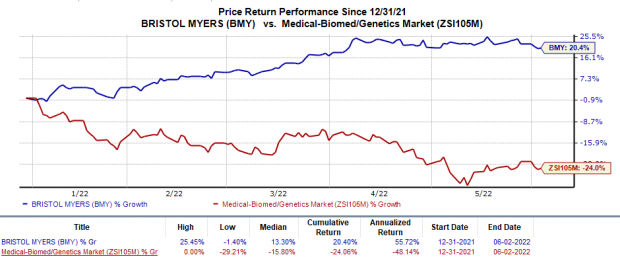

Shares of Bristol Myers have risen 20.4% in the year so far against the

industry

’s 24.1% decrease.

Image Source: Zacks Investment Research

This is one of the many agreements signed between Bristol Myers and Immatics. Both companies entered into their first collaboration in 2019,focused on developing autologous TCR-T. Both companies also expanded this collaboration to include the additional TCR target, discovered by IMTX. As a result of this expansion, Immatics will not only receive an upfront payment of $20 million but will also be eligible to receive milestone payments and royalties.

Last December, Bristol Myers entered into another agreement with Immatics. Per this deal, BMY acquired the rights to license, develop and commercialize IMA401, which is the most advanced candidate in IMTX’s TCR Bispecific pipeline.

The extension of the agreements with Immatics suggests that BMY is firmly focused on expanding its pipeline by investing in allogenic cell therapies. BMY expects that a potential success in developing these therapies will help treat patients with solid tumor malignancies.

Zacks Rank & Stocks to Consider

Bristol Myers currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Alkermes

ALKS

and

Sesen Bio

SESN

, each of which sports a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 60 days. Shares of ALKS have risen 27.9% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, ALKS delivered an earnings surprise of 1,100%.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 60 days. Shares of SESN have dropped 27.9% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, SESN delivered an earnings surprise of 100%.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report