Shares of

BridgeBio Pharma, Inc.

BBIO

were up 14% on Thursday May 12, after management announced that BBIO has inked an exclusive licensing deal with

Bristol Myers

BMY

to develop and commercialize its SHP-2 inhibitor BBP-398, targeting oncology indications.

Per the terms of the agreement, BridgeBio will receive $90 million as an upfront payment from Bristol Myers. BBIO is also eligible to receive up to $815 million of potential milestones as well as tiered royalties in low-to-mid teens.

In addition, BridgeBio will have an option to receive higher royalties on U.S. sales of the drug, provided it funds a portion of development costs upon initiation of registrational studies.

BridgeBio is currently evaluating BBP-398 in three phase I monotherapy and combination studies on solid tumors. While BBIO will continue to lead the ongoing phase I studies on BBP-398, Bristol Myers will lead as well as fund all the future clinical studies evaluating the candidate.

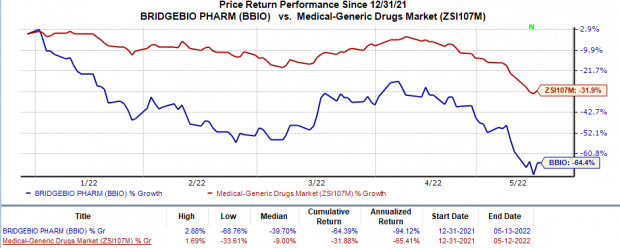

Shares of BridgeBio have plunged 64.4% in the year so far compared with the

industry

’s 31.9% decline.

Image Source: Zacks Investment Research

This licensing agreement between BridgeBio and Bristol Myers is an extension of the non-exclusive clinical collaboration contract signed by the two companies last July. Both companies had reached an agreement to study BBP398 in combination with Opdivo, Bristol Myers’ blockbuster PD-L1 inhibitor, for treating advanced solid tumors carrying KRAS mutations.

Earlier this January, BridgeBio also

entered into a non-exclusive clinical collaboration

with

Amgen

AMGN

to evaluate the combination of BBP-398 with Amgen’s KRAS G12C inhibitor Lumakras in patients with KRAS G12C-mutated advanced solid tumors. Per the agreement terms, BBIO will be responsible for sponsoring the study, while Amgen will be in charge of the worldwide supply of Lumakras.

Currently, BBIO has more than 30 programs in its pipeline and multiple ongoing clinical studies. Most of these pipeline programs are a result of its tie-ups with academic institutions and industry partners.

More than two-third of BridgeBio’s pipeline programs are in collaboration with the leading academic institutions like Columbia University, University of Texas and Standford University. The milestone fees received from Bristol Myers will help BBIO fund these programs, thereby enabling it to develop its pipeline.

Zacks Rank & Stock to Consider

BridgeBio currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is

Alkermes

ALKS

, which sports a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have risen 14.2% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report