Bristol Myers

BMY

has announced that it will acquire clinical-stage precision oncology company

Turning Point Therapeutics

TPTX

for $76.00 per share, which equates to a total transaction value of $4.1 billion. The offer price of $76 represents a 122% premium to Turning Point’s closing price of $34.16 on Jun 2.

The acquisition is expected to close in the third quarter of 2022. It is expected to be up to 8 cents per share dilutive to non-GAAP EPS in 2022 prior to any impact from an acquired in-process research and development charge.

The acquisition will add Turning Point’s lead asset, repotrectinib, a next-generation, potential best-in-class tyrosine kinase inhibitor (TKI) targeting the ROS1 and NTRK oncogenic drivers of non-small cell lung cancer (NSCLC) and other advanced solid tumors.

The FDA has granted three Breakthrough Therapy Designations to the candidate. In the Phase 1/2 TRIDENT-1 clinical trial, a longer duration of response has been observed in the landmark analysis with repotrectinib than with existing ROS1 agents in first-line NSCLC.

Data from the phase 1/ TRIDENT-1 clinical study showed a longer duration of response in the landmark analysis with repotrectinib than with existing ROS1 agents in first-line NSCLC.

Bristol Myers expects a tentative approval of repotrectinib in the United States in the second half of 2023, which should make it a new standard of care for patients with ROS1-positive NSCLC in the first-line setting. The company also plans to continue exploring the potential of Turning Point’s promising pipeline of novel compounds.

The acquisition should strengthen Bristol Myers’ position in the oncology space, particularly in the lucrative lung cancer arena.

Concurrently, Bristol Myers announced that the company has withdrawn the supplemental biologics license application (sBLA) for Reblozyl (luspatercept-aamt) for the treatment of anemia in adults with non-transfusion dependent (NTD) beta thalassemia.

Reblozyl is currently approved in the United States, European Union and Canada to address transfusion-dependent anemia-associated beta thalassemia and lower-risk myelodysplastic syndromes.

The decision was taken after the company could not appropriately address the FDA’s questions about the drug’s benefit-risk profile in this patient population based on the current dataset from the phase II BEYOND study.

The drug is being developed and commercialized through global collaboration with

Merck

MRK

following the latter’s acquisition of Acceleron Pharma, Inc. in November 2021.

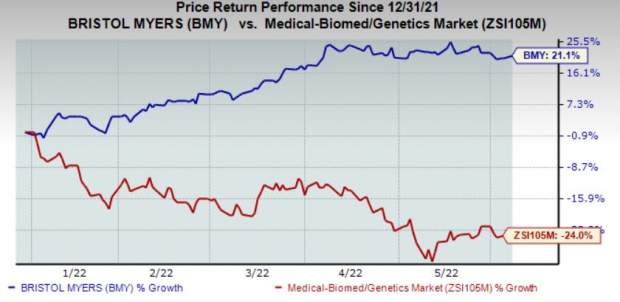

Shares of Bristol Myers have rallied 21.1% year to date against the

industry

’s decline of 24%.

Image Source: Zacks Investment Research

Bristol Myers’ is looking to expand its portfolio for new avenues of revenue as key drug Revlimid faces generics. The performance of the immuno-oncology drug Opdivo, approved for multiple cancer indications, has been good.

However, competition is stiff for Opdivo from the likes of Merck’s blockbuster drug Keytruda. Approved for various oncology indications, Keytruda is MRK’s key driver.

Bristol Myers currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech space is

Alkermes

ALKS

, which sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

ALKS’ loss estimates for 2022 have narrowed to 3 cents from a loss of 14 cents in the past 60 days. Alkermes surpassed earnings in all the trailing four quarters, the average being 350.48%.

Free: Top Stocks for the $30 Trillion Metaverse Boom

The metaverse is a quantum leap for the internet as we currently know it – and it will make some investors rich. Just like the internet, the metaverse is expected to transform how we live, work and play. Zacks has put together a new special report to help readers like you target big profits.

The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks

reveals specific stocks set to skyrocket as this emerging technology develops and expands.

Download Zacks’ Metaverse Report now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report