Bruker Corporation

BRKR

announced the launch of the timsTOF HT system to further enhance the revolutionary 4D Multiomics timsTOF platform at the 70th ASMS meeting.

The timsTOF HT comprises a novel 4th-generation TIMS (trapped ion mobility separation) XR cell and 14bit digitizer for an even higher dynamic range, enhanced peptide coverage and more precise quantitation.

The recent development is likely to expand Bruker’s CALID Group portfolio and fortify the company’s opportunities in proteomics.

About timsTOF HT system

The timsTOF HT instrument can spot more than 100k unique tryptic peptides in 60min gradients, with accurate quantification of better than 5% CVs for numerous protein groups in low microgram quantities of a three-proteome mixture, utilizing the dia-PASEF technique.

The timsTOF HT also is enhanced for high-throughput, deep and unbiased plasma proteomics, and liquid biopsy biomarker research.

More on the News

At the ASMS meeting, Bruker announced that its timsTOF single cell proteomics (SCP) system, with extreme sensitivity, is accessible through a co-distribution agreement with Scienion, along with the CellenONE F1.4 single-cell pico-dispenser and the new ProteoChip, as a single vendor solution for unbiased, label-free SCP.

At ASMS, Bruker presented PaSER’s real-time data streams and feedback loops for intelligent acquisition processes created in partnership with the Yates Lab at Scripps. The users can attribute acquisition parameters ‘on-the-fly’ based on PaSER’s real-time decision-making for PTM targeting, retention time alignment, and dynamic inclusion and exclusion.

Image Source: Zacks Investment Research

Moreover, Bruker noted that its OligoQuest software leverages the high isotopic fidelity and mass accuracy of Bruker’s maXis II and timsTOF platforms. The software provides improved RNA and oligonucleotide characterization for antisense research, RNA therapeutics, confirmation of guide RNA sequences for CRISPR, and other gene-editing techniques.

Implication of the Latest Launch

The dia-PASEF acquisition mode on the timsTOF HT instrument quantifies proteins throughout a large dynamic range, even in difficult samples, such as cardiac tissue, without compromising throughput or sensitivity.

The offering of a complete SCP solution together with Scienion can better tackle the needs of the single-cell proteomics community by bringing together the expertise for accelerated research solutions development in single-cell proteomics.

The high sensitivity timsTOF Pro 2 system aids in pioneering small molecule biomarker discovery partners in transforming metabolomics at a record scale. New workflows for discovering biomarkers to advance drug discovery and novel natural products take advantage of the robustness, speed and confidence of the timsTOF platform in 4D metabolomics.

Industry Prospects

Going by a

Market Research Future report

, the global proteomics market size was $23.2 billion in 2017. It is expected to witness a CAGR of 14.1% by 2023.

Recent Developments

In April 2022, Bruker announced the acquisition of Optimal Industrial Automation and Technologies — a provider of pharma and biopharma process analytical technology. The acquisition is intended to strengthen Bruker as a key software and solutions provider for small molecule, biologics and new drug modalities pharma companies.

In the same month, Bruker acquired IonSense Inc. — the innovator of ambient DART (Direct Analysis in Real Time) ionization technology. The agreement will utilize Bruker’s strong presence and reputation in analytical instrumentation, as well as investments in IonSense to bring the latter’s enabling technology to a larger customer base soon.

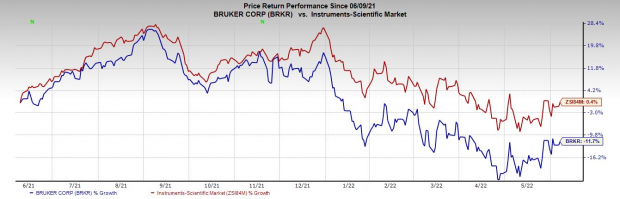

Price Performance

Shares of the company have lost 11.7% in a year compared with the

industry

‘s fall of 0.4%.

Zacks Rank and Key Picks

Bruker currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are

UnitedHealth Group Incorporated

UNH

,

Medpace Holdings, Inc.

MEDP

and

Alkermes plc

ALKS

.

UnitedHealth, having a Zacks Rank #2 (Buy), reported first-quarter 2022 earnings per share (EPS) of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 14.2%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Medpace reported first-quarter 2022 adjusted EPS of $1.69, which surpassed the Zacks Consensus Estimate by 34.1%. Revenues of $330.9 million outpaced the Zacks Consensus Estimate by 1.1%. It currently has a Zacks Rank #2.

Medpace has a historical growth rate of 27.3%. MEDP’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which surpassed the Zacks Consensus Estimate of a penny. Revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. It currently sports a Zacks Rank #1.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report