Like a strong gust of wind swaying a tree in a certain direction, most stocks tend to follow the general market action. One of the best ways to avoid paralysis by analysis in the stock market is by simply focusing on how a stock’s price is acting in relation to the general market. For example, if the Nasdaq is down 2% on the day it’s a good bet that

Apple (AAPL)

and

Amazon

AMZN

are also down. Using the same scenario, if

Netflix

NFLX

were up with the Nasdaq down 2% it would be a sign of relative strength.

The concept of relative strength can be compared to coiled spring with a weight on top of it or a beach ball held under water. As soon as the force weighing it down (in this case, the market weakness) is removed, the stock should move higher. In other words, stocks that can resist market weakness, often become top performers once the downward pressure is alleviated. The optimal time to look for relative strength is when the general market pulls back. Because most stocks will be in sync with the downward direction, the stocks with the most robust relative strength will stick out like a sore thumb. Relative strength can be used for different time frames. Below we will look at stocks that are exuding relative strength this week as the market has pulled back:

Super Micro Computer Inc. (SMCI)

In the face of the recent tech meltdown and slowing growth,

Super Micro Computer

SMCI

has been the exception and has shown super performance. On July 1st, the provider of high-performance and high-efficiency servers exceeded earnings expectations for a fourth straight quarter. The most recent quarter’s earnings grew by a whopping 490% versus last year, while the company raised guidance for its next quarter. According to Zack’s research,earnings estimate revisions can be key to finding big winners.

Image Source: Zacks Investment Research

Pictured: SMCI’s EPS line overlaying price.

From a technical perspective, investors cheered the news, sending shares vaulting by more than 12% on volume nearly five times the 50-day average. Volume can be a powerful indicator. Savvy investors often use volume to gauge demand and institutional appetite for a stock. As of the close on Wednesday, the stock is flat for the week. SMCI has displayed outstanding relative strength across all time frames.

Moderna Inc

MRNA

Moderna (MRNA),

the manufacturer of the Covid-19 vaccine, was one of the biggest winners over the past few years. Rising from relative obscurity to being a household name, Moderna rode the vaccine wave higher before finally correcting.

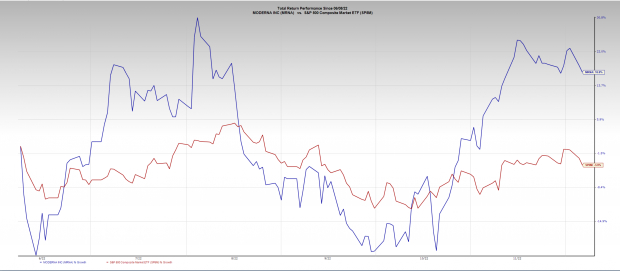

Image Source: Zacks Investment Research

Pictured: Moderna (blue line) has outpaced the S&P by gaining 16% over the last 6 months versus -3% returns on the S&P.

Though Moderna has matured out of its Covid-induced growth phase, the stock is more attractive from a valuation perspective. Currently, Moderna sports a trailing-twelve-month P/E of 6.28x, much lower than the 19.40x that the Zacks Medical -Biomedical and Genetics group has.

Lennar Corporation

LEN

Despite challenging economic conditions, a rising interest rate environment, and an evolving housing market,

Lennar (LEN)

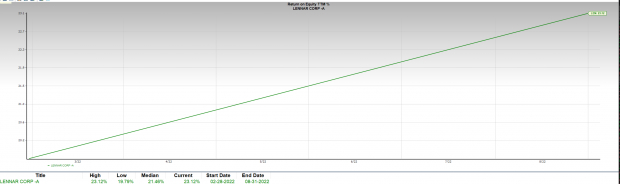

has defied the odds. Lennar, one of the nation’s leading homebuilders, topped earnings estimates last quarter and grew non-GAAP EPS by a healthy 58%. Not only is Lennar growing revenue and earnings, but it is also becoming more financially efficient. Over the past twelve months, Lennar’s return on equity (ROE) has grown from below 16 to 23.

Image Source: Zacks Investment Research

Pictured: Lennar’s impressive growth in financial efficency (ROE).

Beyond Lennar’s positive fundamental attributes, the homebuilder created buzz last month when it announced that it would embark on the constructing the world’s largest 3-d printed community. LEN gained 3.61% Wednesday, spurred on by a positive earnings report from industry group peer

Toll Brothers Inc

TOL

.

Lennar is set to report earnings on December 14

th

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report