Shares of

The Buckle, Inc.

BKE

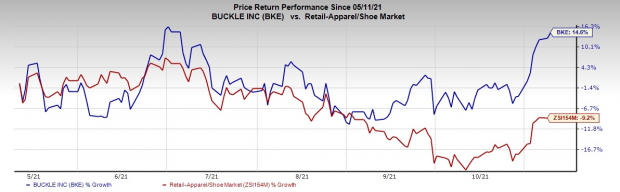

have increased 14.6% in the past six months, thanks to its robust strategic efforts and an impressive sales trend. The company has been putting up a stellar show for quite sometime now, which continued in October too. Solid gains from the company’s women’s and men’s merchandise categories steadily contributed to this upbeat sales performance. Comparable store net sales for the same fiscal month proved to be impressive as well.

Shares of this currently Zacks Rank #3 (Hold) company have outperformed the

industry

’s 9.2% fall in a six-month time period. The stock has jumped 3.8% since the announcement of the company’s October sales results on Nov 4.

Let’s get into the numerical details.

Image Source: Zacks Investment Research

Robust Sales Run

Buckle’s net sales for the four-week fiscal month ended Oct 30, 2021 rose 23.6% to $96.5 million from $78.1 million recorded in the four-week fiscal month ended Oct 31, 2020. We note that this apparel, footwear and accessories retailer registered a sales increase of 17.3%, 43%, 33.8%, 17.8%, 75.4% and 718%, respectively, in the preceding six months. For the fiscal month under review, comparable store net sales for stores open at least one year, climbed 23.3% year over year.

For the same period, total sales at the men’s unit increased 26% from the figure recorded in the four-week period ended Oct 31, 2020 while the metric at the women’s business jumped 20.5%. While the men’s category contributed 51.5% to the company’s overall monthly sales, the women’s unit accounted for 48.5%.

On combining the men’s and women’s categories, accessory sales for the fiscal month climbed 25% while footwear sales rose 20% from the figure registered in the comparable fiscal October of 2020. The accessory and footwear categories accounted for 8% and 11%, respectively, of the overall fiscal October 2021 sales. For the comparable period in fiscal 2020, sales constituted 8% and 11.5%, respectively.

For the 39-week fiscal period ended Oct 30, 2021, Buckle’s net sales surged 56.9% to $913.7 million from $582.4 million recorded in the previous year 39-week fiscal period ended Oct 31, 2020. Comparable store net sales also soared 56.7% from the year-ago period’s figure for the 35-week fiscal period.

What’s More?

Management announced that the company will release

third-quarter fiscal 2021 earnings

on Nov 19, 2021, before market open.

We note that Buckle continues to benefit from its product assortments and youth business. The company added a youth top-to-bottom assortment to more than 75 of its flagship stores, thus bringing the total to 350 stores housing youth products. Also, the company is making constant efforts to boost its online capabilities. Its store-growth initiatives are encouraging as well.

The Kearney, NE-based company presently operates 441 retail outlets across 42 states compared with 446 stores as of Nov 4, 2020. On its second-quarter earnings call, management had forecast competing six additional full remodeling projects in the rest of fiscal 2021. It expected capital expenditures worth $12-$15 million, intended toward planned store projects and IT investments.

Key Picks in Retail

Capri Holdings

CPRI

has a long-term earnings growth rate of 56.3% and a Zacks Rank #1 (Strong Buy), presently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Boot Barn

BOOT

, presently a Zacks #1 Ranked stock, delivered an earnings surprise of 35.3% in the trailing four quarters, on average.

Levi Strauss

LEVI

has an earnings surprise of 66.6% in the trailing four quarters, on average. The company presently carries a Zacks Rank #2 (Buy).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report