Baidu

BIDU

, a Zacks Rank #1 (Strong Buy), has enjoyed a recent surge higher following a softening of China’s restrictive COVID policies. Chinese equities have responded well to China’s reopening, which should help to boost the economy and corporate profits. BIDU stock appears to have bottomed out in late October, staging a new uptrend and making a series of higher highs. This presents a notable shift in sentiment from the past two years and points to continued strength.

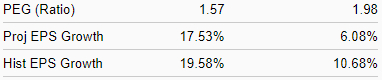

Baidu is part of the Zacks Internet – Services industry group, which ranks in the top 38% out of more than 250 Zacks Ranked Industries. Because this group is ranked in the top half of all industries, we expect it to outperform the market over the next 3 to 6 months. Also note the favorable metrics for this industry group below:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

BIDU is a Chinese-language internet search provider based in Beijing. The company offers a host of services such as Baidu App which allows users to access feed services on mobile devices; Baidu Search to access its search capabilities; and Baidu Feed which provides users with a personalized timeline based on their demographics and interests. BIDU also offers various cloud services and solutions, in addition to online marketing services that include pay for performance, auction-based services that allow customers to bid for priority placement of paid sponsored links.

Just yesterday, a host of Chinese companies (including BIDU) surged following foreign regulatory approval for a fundraising plan in relation to billionaire Jack Ma’s Ant Group. The decision points to a softening between Chinese authorities and the country’s tech giants, a favorable move that could further bolster BIDU shares.

Earnings Trends and Future Estimates

BIDU has built up an impressive earnings history, surpassing earnings estimates in each of the past four quarters. Back in November, the company reported Q3 EPS of $2.37/share, a 0.85% surprise over the $2.35 consensus estimate. BIDU has delivered a +50.17% average earnings surprise over the last four quarters.

The outlook remains favorable for Baidu, as analysts covering the company have increased their Q1 ‘23 EPS estimates by +5.56% in the past 60 days. The Q1 Zacks Consensus EPS Estimate now stands at $2.28/share, reflecting potential growth of 28.81% relative to last year.

Zooming out a bit and looking at the 2023 year as a whole, earnings are projected to rise 25.95% versus this past year to $10.92/share. Sales are anticipated to climb 11.2% to $19.39 billion.

Let’s Get Technical

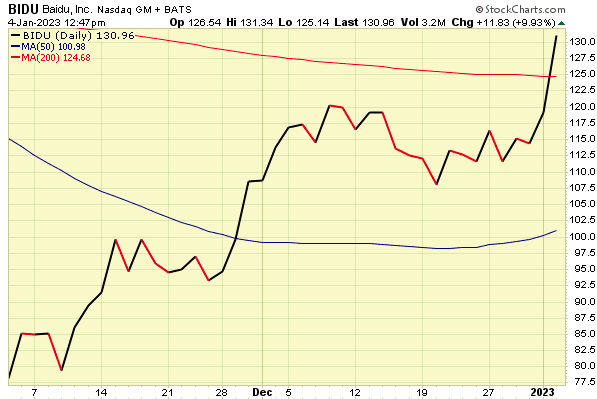

BIDU shares are surging to kick off the new year. Only stocks that are in extremely powerful uptrends deviate from the general market, which continues to hover in a deep correction. This is the kind of stock we want to include in our portfolio – one that is starting to trend well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how the 50-day moving average (blue line) is now sloping up. BIDU has also now crossed back above its 200-day moving average (red line) – another bullish signal. With both strong fundamentals and technicals, BIDU is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, BIDU has recently witnessed positive revisions. As long as this trend remains intact (and BIDU continues to deliver earnings beats), the stock will likely continue its bullish run this year.

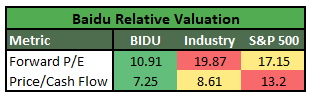

Despite the impressive price run off the lows, BIDU currently remains relatively undervalued:

Image Source: Zacks Investment Research

Bottom Line

As the Chinese economy bounces back from weaker growth due to overly restrictive pandemic policies, Chinese stocks are moving higher. Backed by a leading industry group and robust history of earnings beats, this top-rated stock is poised to continue its recent run. Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix.

Recent institutional buying should continue to provide a tailwind for the stock price. It’s not too difficult to see why this company is a compelling investment. Investors would be wise to consider BIDU as a portfolio candidate if they haven’t already done so.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report