JinkoSolar

JKS

is one of the largest solar panel manufacturers on the planet and it stands to benefit from the massive expansion of renewable and alternative energy in the U.S. and beyond. The solar giant’s earnings outlook for next year has soared since its Q3 release in late October.

JinkoSolar stock is trading well off its highs and its valuation levels are extremely enticing for a growth-focused company in a potentially game-changing industry. Plus, JKS stock soared above a key moving average on Wednesday.

JinkoSolar Basics

JinkoSolar makes various types of solar panels geared toward different aspects of the market. The company sells its offerings to residential customers for their roofs, as well as high-performance systems for localized industrial and commercial energy production. JKS also sells its photovoltaic (PV) panels to larger energy and electricity producers.

JinkoSolar boasts that more than a million homes around the world have been fitted with JinkoSolar’s PV panels. JKS has benefited from an internal push from the Chinese government to boost solar panel production in the country.

JinkoSolar’s vertically integrated manufacturing process helps it lower the costs of producing complicated, high-tech PV panels. JinkoSolar operates out of 14 global production bases in China, U.S., Malaysia, and Vietnam. Production outside of China is key as tension rise between the U.S. and the world’s second-largest economy.

Image Source: Zacks Investment Research

Solar’s Expansion & Upside

The nearby chart showcases JinkoSolar’s impressive revenue growth. Yet all of this expansion is rather new. In fact, solar panels and solar energy didn’t gain any real traction until the mid-2010s.

Solar is now a massive industry that’s been spurred by a mixture of government forces and incentives, as well as public and private investment. The expansion of wind and solar helped renewables expand their share of the U.S. electricity generation mix from 10% in 2010—when it was mostly from hydroelectric—to 20% last year.

Overall, solar accounts for roughly 3% of total U.S. electricity generation. Meanwhile, renewables only make up about 12% of total U.S. primary energy consumption, with solar making up just 12% of that slice of the pie.

The mixture of rapid growth and massive upside is what makes the solar energy industry so intriguing. The U.S. Energy Information Administration projects that renewables will double their share of the U.S. electricity generation mix by 2050, with solar making up a large chunk of those gains. And alternative energy now accounts for 75% of the growth in overall global energy investment.

Image Source: Zacks Investment Research

Growth Outlook

The Chinese solar firm’s global module shipments doubled year-over-year in Q3. The company is also successfully boosting both its production efficiency and rolling our more efficient panels, which are both crucial to the long-term growth of the industry.

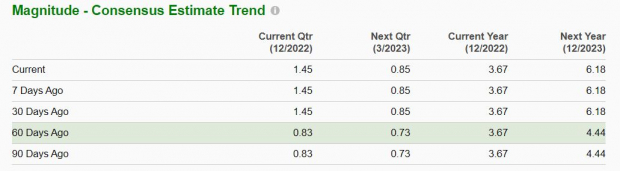

JinkoSolar’s profitability improved sequentially in Q3, with its gross margin up 100 basis points to 15.7%. Analysts raced to boost their FY23 estimates following its Q3 release, which is no easy task amid the current economic environment.

Zacks estimates call for its revenue to skyrocket 84% in 2022 from $6.34 billion to $11.65 billion (on top of 19% growth last year). The firm is then projected to boost its sales by another 40% in FY23 all the way to $16.34 billion—a $10 billion expansion in just two years.

JinkoSolar’s adjusted earnings are projected to soar 116% in FY22 to hit $3.67 per share and then climb 68% higher in FY23. Plus, its consensus EPS estimate for 2023 has jumped 39% since its release to help it land a Zacks Rank #1 (Strong Buy) right now.

Price Performance and Valuation

JinkoSolar stock has climbed 105% in the past five years to lag its industry, with JKS up 175% over the past three years vs. the Zacks Solar industry’s 160% climb. More recently, JKS has managed to jump 10% in 2022.

Despite the showing in 2022, JinkoSolar stock has tumbled since the summer to trade around 33% below its highs. This pullback sets up a nice entry point. Plus, its current price target offers nearly 30% upside to Wednesday’s closing price. And the stock jumped above its 50-day moving average on Wednesday after it soared during regular hours.

JinkoSolar trades at just 7.7X forward 12-month earnings vs. the Zacks Solar industry’s 44.1X average. This group of companies includes other standouts such as First Solar

FSLR

and Sunrun

RUN

.

Both First Solar and Sunrun are part of the solar PV space. First Solar trades at 37.1X forward earnings, while Sunrun trades at over 60X. These examples help highlight how much value JinkoSolar offers investors. JinkoSolar also trades well below the S&P 500’s 17.5X, as well as a 40% discount to its own five-year median.

Image Source: Zacks Investment Research

Bottom Line

Investors should be aware that the U.S. government and the Biden administration are trying to curb imports of Chinese solar panels as the country tries to boost its own production, which is microscopic by comparison. That said, JinkoSolar now makes panels in various parts of the world and sells them in China, Europe, and beyond. And the U.S. simply needs the panels as it tries to reach its self-imposed emissions goals.

JinkoSolar’s growth outlook is clearly impressive as the solar industry gains momentum in the U.S., China, Europe, and beyond. Solar accounts for only a tiny fraction of U.S. power generation right now, but its role is expected to soar in the coming decades.

Investors might want to consider adding exposure to at least a few solar stocks. JinkoSolar offers investors the chance to do just that through its ADR shares which are trading at a big discount to their highs. Plus, JKS currently presents an excellent mixture of near-term and long-term growth, coupled with impressive value.

As a note, I own JinkoSolar stock as part of Zacks newest trading service –

Alternative Energy Innovators

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report