Monster Beverage Corporation

MNST

looks poised for growth in the long term, owing to the continued momentum in its energy drinks business. The company has been well-placed amid competition, given its commitment to product launches and innovation. It remains on track to launch a number of additional products and product lines in domestic and international markets later this year.

Monster Beverage retained investors’ bullish sentiments by maintaining a robust earnings beat streak, with an average trailing four-quarter surprise of 4.2%. The top line surpassed estimates in the last four quarters. This underlines the company’s operational excellence.

In second-quarter 2021, net sales grew 33% year over year. Robust year-over-year top-line comparisons mainly reflected more severe impacts of the pandemic in the year-ago quarter. Earnings improved 28.6% year over year.

In the past 30 days, estimates for the company’s 2021 and 2022 earnings per share have been unchanged. For 2021, its earnings estimates stand at $2.62 per share, suggesting a rise of 10.6% from the year-ago reported figure.

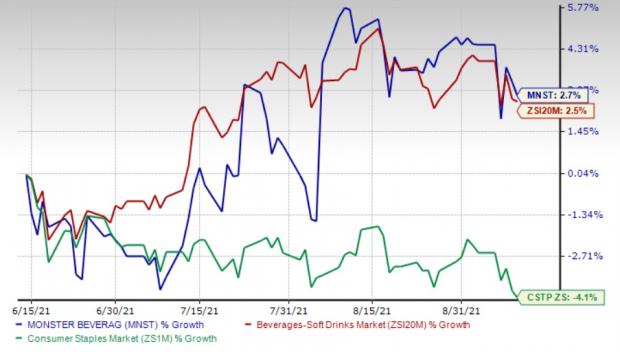

The Zacks Rank #3 (Hold) stock has gained 2.7% in the past three months compared with the

industry

’s growth of 2.5%. The stock also compared favorably with the Consumer Staples sector’s decline of 4.1% in the same period.

Image Source: Zacks Investment Research

Factors Supporting Growth

Monster Beverage offers a wide range of energy drink brands such as Monster Energy, Java Monster, Cafe Monster, Espresso Monster, Monster Energy Mule, Juice Monster Pipeline Punch, Juice Monster Pacific Punch, Juice Monster Mango Loco, Monster Ultra Paradise, and Monster Hydra Sport. Continued strength in the energy drinks category has been a key growth driver for the company.

Product innovation also plays a significant role in the company’s success. Its product launches in the United States in the first half of 2021 were focused on in the first quarter. In the second quarter, it refreshed the can graphics for its Rehab Monster brand family and the Full Throttle line. It also updated the name of Blue Agave to TrueBlue. It is on track to launch a line of non-alcoholic energy sale under the True North brand in 12-ounce sleek cans. It plans to complete the full launch of True North in the mainstream channels in 2022.

In Canada, it launched two products — Monster Punch Papillon and Monster Punch Khaotic — in the second quarter. Other launches included Reign Orange Dreamsicle in Puerto Rico; a second SKU in Bolivia, with Monster Energy Zero Ultra; Fury Mean Green in El Salvador; Juice Monster Pacific Punch and Monarch in Many EMEA countries; Monster Energy Super Cola in Japan; Pipeline Punch in Taiwan, Hong Kong and Macau; and Ultra Paradise and Ultra Fiesta in many countries. Management remains on track to launch a number of additional products and product lines in domestic and international markets later this year.

Management remains optimistic about strength in the energy drinks category with the Monster Energy brand growing significantly. Product launches across the Monster family will drive the company’s overall top and bottom lines.

Hurdles to Overcome

Like others in the industry, Monster Beverage has been facing hardships related to logistics and supply chain challenges, which weighed on margins in the second quarter. In second-quarter 2021, Monster Beverage continued to witness shortages in its aluminum can requirements in North America and Europe, owing to its higher volume growth and the ongoing supply constraints in the aluminum can industry. The company is also witnessing delays in the procurement of certain ingredients, both domestically and internationally. This has led to heightened challenges in meeting the increased consumer demand in North America and EMEA in the second quarter.

The company is also faced with freight inefficiencies as well as significant increases in domestic and international freight costs. It is experiencing higher input costs, particularly for aluminum, and other costs in the current environment. These headwinds have resulted in higher cost of sales as well as increased operating expenses in the second quarter, impacting both gross and operating margins.

Adverse geographical sales mix and higher input costs caused by increased raw material freight-in costs and aluminum can costs hurt the gross margin in the second quarter.

To meet the demand shortages witnessed in second-quarter 2021, Monster Beverage has taken steps to source additional quantities of aluminum cans in excess of its contracted volumes from the United States, South America and Asia. It has also entered supply agreements with two suppliers of aluminum can in the United States, which are anticipated to be operational in the fourth quarter of 2021.

However, management expects logistical issues, including shortages of shipping containers and global port of entry congestion to delay the arrival of imported cans, with deliveries likely to increase sequentially in the second half of 2021. It expects challenges related to the supply constraints in the aluminum can industry, shortages of shipping containers, global port congestions, and higher freight and input costs to continue for the next few months. This will continue to adversely impact gross margin rates.

Better-Ranked Stocks to Watch

The Hershey Company

HSY

has a long-term earnings growth rate of 7.7%. It currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Coca-Cola Company

KO

, with a Zacks Rank #2 at present, has a long-term earnings growth rate of 8.7%.

Sysco Corporation

SYY

, also a Zacks Rank #2 stock, has a long-term earnings growth rate of 9%.

Tech IPOs With Massive Profit Potential:

Last years top IPOs surged as much as 299% within the first two months. With record amounts of cash flooding into IPOs and a record-setting stock market, this year could be even more lucrative.

See Zacks’ Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report