Canadian Solar Inc.

’s

CSIQ

subsidiary, Recurrent Energy, recently announced an agreement to sell the Gaskell West 2 and 3 projects to Matrix Renewables. Located in Kern County, CA, this solar plus storage project comes with a generation capacity of 105 megawatt-alternate current (MWac) plus 80 MWh energy storage.

The hybrid project, expected to reach commercial operation in late 2022, will generate enough clean electricity to displace approximately 178,500 metric tons of carbon emissions each year.

Canadian Solar’s Place in California

Per the U.S. Energy Information Administration (EIA), California is the United States’ top producer of electricity from solar. This offers solid growth opportunities for solar players like Canadian Solar to expand their footprint in this state through the construction of solar projects like Gaskell. The subsequent sale of this project will thereby boost CSIQ’s revenues in the coming days.

Realizing the growth trends of California’s solar market, Canadian Solar has been enhancing its business in this state for quite some time now. In fact, the Gaskell project is yet another battery storage project offered by Canadian Solar in California, following the Mustang, Slate and Crimson battery storage projects.

Looking ahead, 19,501 MW of solar installations are projected in California over the next five years, as stated by the Solar Energy Industries Association. This should offer Canadian Solar more incentive to develop projects and subsequently sell them to derive the benefits of project monetization in the expanding Californian solar market.

Prospects in Battery Storage

Per the Preliminary Monthly Electric Generator Inventory report published by the EIA, solar power and battery storage projects are projected to constitute 60% of the 85 gigawatts (GW) of new electricity generating capacity to be added in the United States during the 2022-2023 period.

Such a solid projection brings the spotlight not only on Canadian Solar but also on other solar stocks that are particularly engaged in manufacturing and handling storage batteries and associated technologies like

Enphase Energy

ENPH

,

SolarEdge Technologies

SEDG

, and

SunPower

SPWR

.

Enphase Energy manufactures fully-integrated solar-plus-storage solutions. Its next-generation battery in North America is Enphase Encharge 3 and Encharge 10 storage systems, with a usable and scalable capacity of 3.4 kWh and 10.1 kWh, respectively.

Enphase boasts a four-quarter average earnings surprise of 29.6%. The Zacks Consensus Estimate for 2022 earnings and sales suggests a 30.7% and 47.3% improvement from the prior-year reported figures, respectively.

SolarEdge Technologies launched its residential battery, the SolarEdge energy bank, in 2021. This is a 10-kW single-phase battery that integrates with its SolarEdge energy hub family of inverters. Some existing SolarEdge systems can be upgraded with a storage solution for both backup and on-grid maximum self-consumption use.

The stock boasts a long-term earnings growth rate of 23%. The Zacks Consensus Estimate for 2022 earnings indicates a 47.8% improvement from the prior-year reported figure.

SunPower’s SunVault storage solution is primarily designed for residential customers and its two-box solution fits in indoor/outdoor areas. In fourth-quarter fiscal 2021, the company launched its Virtual Power Plant, which will enable SunVault energy storage customers to get paid for allowing the utility to use stored energy during peak demand and contribute to a more stable power grid in their community.

The company boasts a long-term earnings growth rate of 215.6%. The Zacks Consensus Estimate for 2022 earnings implies a solid 457% improvement from the prior-year reported figure.

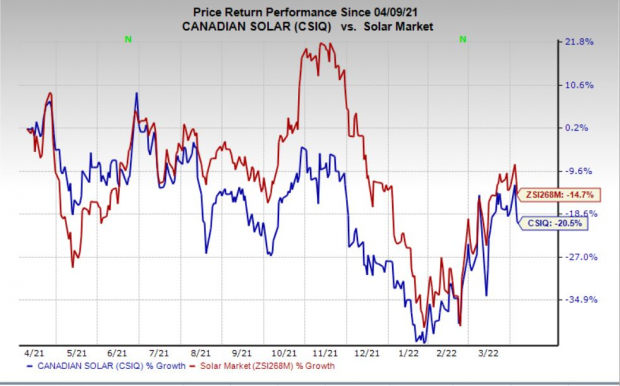

Zacks Rank & Price Performance

Canadian Solar currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Canadian Solar’s shares have lost 20.5% in the past year compared with the

industry

’s decline of 14.7%.

Image Source: Zacks Investment Research

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report