Canadian Solar Inc

.

CSIQ

has been recently awarded the rights to develop the first utility-scale battery storage project of 45 MW / 45 MWh in Colombia by the state’s Ministry of Energy and Mines. The energy storage project, located in the city of Barranquilla, will consist of a 45-MWh lithium-ion battery energy storage system. The project is expected to reach commercial operation by June 2023.

Latin America BESS Market

Battery storage has been gaining a strong foothold in the wider Latin American region, with potential for greater renewables integration. In the Latin American region, battery energy storage systems (BESS) are being installed in large numbers across various electricity distribution networks, remote area power supplies, homes, and other commercial installations. Here, the Lithium-ion batteries segment is dominating the battery energy storage system market. Falling equipment costs have helped guarantee the profitability of storage components in generation projects. These factors in recent years have certainly boosted the BESS market in Latin America, which also promotes renewable energy that is assessed to large-scaled grids.

Canadian Solar is expected to benefit from a 15-year revenue stream, as the newly acquired project is granted a 15-year revenue structure with the Colombian government. The project will also strengthen the electricity transmission network in northern Colombia, alongside supporting a greater penetration of renewable energy in the Colombian electricity system. As this is the first energy storage project in Colombia and the Latin American region, all such impressive growth prospects should bolster and expand Canadian Solar’s footprint in the region.

Future Prospects

Per the Markets and Markets research firm, the battery energy storage system market is projected to witness a CAGR of 32.8% from $2.9 billion in 2020 to $12.1 billion by 2025. This should benefit companies like Canadian Solar, which are expanding in the battery energy storage market.

Other companies with a strong presence in the battery storage market are also poised to benefit from the aforementioned market growth opportunities.

For instance,

Enphase Energy

’s

ENPH

next-generation battery — Enphase Encharge 3 or Encharge 10 storage systems — has usable and scalable capacities of 3.4 kWh and 10.1 kWh, respectively. The company expects further revisions of its storage products with Ensemble technology to be released in 2021.

NextEra Energy

NEE

is a prominent stock in the energy storage market, with more than 150 MW of battery energy storage systems in operation. The company’s 409-MW Manatee Energy Storage Center, which will be the world’s largest integrated solar-powered battery system, is currently on track to be placed in service later in 2021.

General Electric

’s

GE

renewable energy division offers customized storage products that include advanced lead-acid batteries as well as Energy Management Systems to integrate the battery management system into a fully functional storage digital controller. It currently has more than 207 MWh of energy storage in operation or construction, globally.

Zacks Rank & Price Movement

Canadian Solar currently carries a Zacks Rank #5 (Strong Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

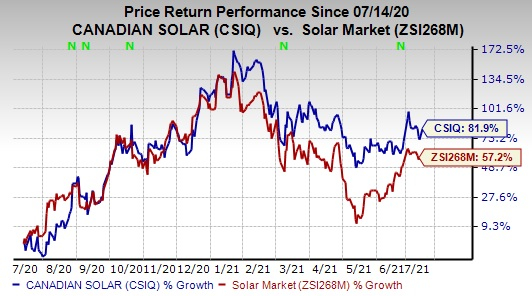

Shares of Canadian Solar have surged 81.9% in the past year compared with the

industry

’s 57.2% growth.

Image Source: Zacks Investment Research

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report