Ciena

CIEN

has announced that its coherent optics solutions were leveraged by Uruguay-based telecommunications company – Dedicado.

Dedicado will utilize Ciena’s 6500 Packet-Optical Platform powered by WaveLogic 5 Extreme (WL5e) coherent optical technology to support the rising demand for network connectivity.

Ciena’s technology will provide 600G to 800G network and is expected to deliver speeds up to 25.2 Tbps between Argentina and Uruguay. This will strengthen the network to support 5G and over-the-top services.

Dedicado will also deploy Ciena’s technology across terrestrial and submarine links. Ciena highlighted that its WL5e has a cheaper cost per bit, more service density and uses less power compared to other providers.

Ciena’s Manage, Control and Plan (MCP) will provide analytical insights to enhance network performance and consumers’ digital experience.

In September 2022, Ciena

announced

that its coherent optics solutions were recently leveraged by Indonesia-based infrastructure company Biznet.

In collaboration with Ciena’s partner Terrabit Networks, Biznet will utilize Ciena’s 6500 Packet Optical Platform, powered by WaveLogic coherent optics. This will aid Biznet in boosting the network capacity, coverage and adaptability of the New Biznet Fiber.

Prior to that, Ciena announced that its 6500, WL5e coherent optical solution and MCP domain controller are being used by MSA Resources Sdn Bhd to build the Digital Super Highway Network.

CIEN is a leading provider of optical networking equipment, software and services. The company continues to benefit from increased network traffic, demand for bandwidth and adoption of cloud architectures.

The company

reported

fourth-quarter fiscal 2022 (ended Oct 29, 2022) results, with adjusted earnings of 61 cents per share, beating the Zacks Consensus Estimate of 8 cents. However, earnings declined year over year by 28.2%.

Quarterly total revenues were down 6.8% year over year to $971 million owing to supply-chain disruptions. The top line surpassed the Zacks Consensus Estimate by 14%. Ciena stated that revenues are likely to start improving from fiscal 2023, owing to strong secular demand trends coupled with easing supply-chain issues.

For the fourth quarter ended, the company had 776 100G+ customers, including 17 and 15 new customer wins on WaveLogic Ai and WaveLogic 5 Extreme, respectively.

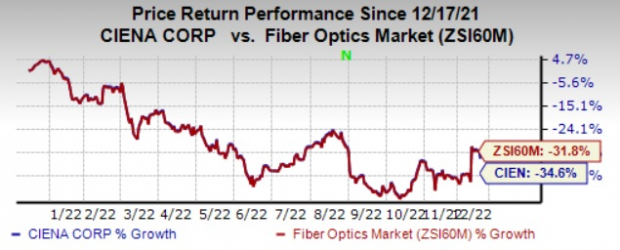

CIEN currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 34.6% compared with the

industry’s

decline of 31.8% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Arista Networks

ANET

,

Plexus

PLXS

and

Super Micro Computer

SMCI

, each presently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have declined 0.9% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have gained 14.5% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.58 per share, rising 23.6% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all of the last four quarters, the average being 9.4%. Shares of SMCI have soared 112.7% in the past year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report