Ciena

CIEN

has announced that its Waveserver 5 platform, powered by WaveLogic 5 Extreme (WL5e) coherent optics, is being deployed by Brazil-based Alloha Fibra group’s subsidiary Mob Telecom (Mob).

The current collaboration addresses the robust demand for bandwidth services like 5G and cloud-based applications.

Mob will integrate Ciena’s platforms to provide bandwidth connectivity up to 800Gb/s per channel across several data centers and four cable landing stations in Fortaleza, Brazil.

Additionally, Mob will leverage Ciena’s 6500 photonic line technology, which combines photonic restoration with L0 control plane to improve network resilience and service availability, and provide a wide array of unique capabilities.

Ciena’s Manage, Control and Plan (MCP) will provide analytical insights to enhance network performance and consumers’ digital experience.

Ciena’s 6500, WL5e

coherent

optical solution and MCP domain controller are being used by MSA Resources Sdn Bhd (“MSAR”) to build the Digital Super Highway Network.

Ciena’s WL5e programmable 800G transponder platform was deployed by MSAR with the help of CommVerge Solutions. It will attain a data transmission speed of 800Gb/s line rate and a total network capacity of 33.6Tb/s per fiber pair, per company estimates.

Prior to that, Ciena’s 6500 Packet-Optical Platforms with WL5e powered by WaveLogic Ai transponders and a 6500 flexible grid ROADM (reconfigurable optical add/drop multiplexers) line system were being used by Columbia-based telecommunications operator Media Commerce amid increasing bandwidth demand.

CIEN is a leading provider of optical networking equipment, software and services. It is observing positive industry trends, such as an increase in consumer spending and continues to profit from rising network traffic, bandwidth demand and cloud architecture adoption.

However, the company is facing supply chain issues due to the pandemic, which led to a decline in its revenue outlook for fiscal 2022. This is a major concern as it relies heavily on third-party manufacturers for supply operations.

Stiff competition, increasing component costs and logistics expenses are concerns.

In the last

reported quarter

, total revenues rose 13.8% year over year to $949.2 million, owing to strong demand trends.

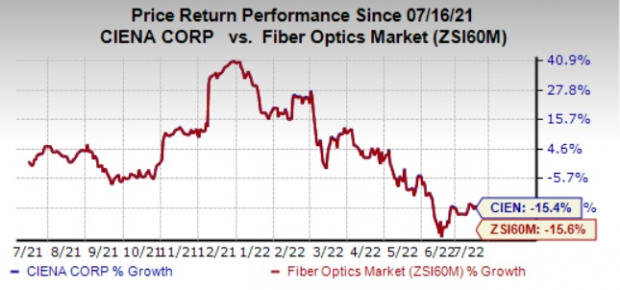

CIEN currently carries a Zacks Rank #4 (Sell). Shares of the company have declined 15.4% compared with the

industry’s

decrease of 15.6% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Aspen Technology

AZPN

,

Synopsys

SNPS

and

Broadcom

AVGO

, each sporting a Zacks Rank #1 (Strong Buy).You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.50 per share, increasing 1.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.4%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 23.8% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.47 per share, rising 7.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 9.9% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.06 per share, up 3.9% in the past 60 days. AVGO’s expected long-term earnings growth rate is 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have gained 1.5% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report