Clovis Oncology, Inc.

CLVS

announced that the company and some of its subsidiaries initiated voluntary prearranged Chapter 11 proceedings in the U.S. Bankruptcy Court for the Southern District of Delaware (“Court”).

In the Court filing. Clovis has estimated its assets to be $100-$500 million, with liabilities between $500 million and $1 billion.

Last month, management had warned investors that a bankruptcy filing was plausible as recent regulatory developments impacted current revenues and the commercial potential of its sole-marketed drug Rubraca.

Since the onset of the year, Clovis has been facing continuing challenges in raising additional capital as a result of the uncertain market potential of Rubraca. Despite making efforts to secure funding, it failed.

Subject to Court approval, management has lined up a debtor-in-possession (DIP) financing facility of up to $75 million to provide it with the necessary liquidity to continue its normal day-to-day business operations throughout the bankruptcy proceedings.

Prior to the bankruptcy filing, Clovis also entered into a stalking horse purchase and assignment agreement with

Novartis

NVS

to sell the rights to its pipeline clinical candidate FAP-2286, which is in an early-stage study for multiple tumor types. Signing a stalking-horse agreement will allow a distressed company to avoid receiving low bids as it sells its final assets. It helps the company set a low-end bidding bar so that other potential buyers cannot underbid the purchase price.

Per the terms of the stalking horse agreement with Novartis, Clovis will be eligible to receive an upfront payment of $50 million. The company is also eligible to receive up to $333.75 million as development and regulatory milestone payments from Novartis. If FAP-2286 is approved, Clovis will be further eligible to receive $297 million as sales milestones from Novartis.

Management is also in discussions with several interested parties regarding a potential sale of one or more of its other assets.

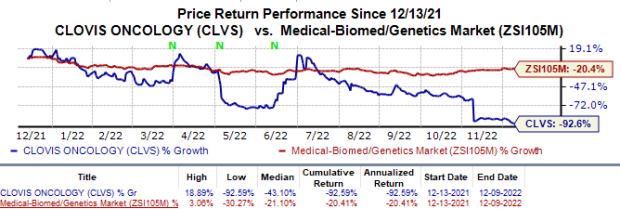

Shares of Clovis have slumped 92.6% in the year compared with the

industry

’s 20.4% fall.

Image Source: Zacks Investment Research

As of September 2022-end, Clovis’ cash, cash equivalents and marketable securities were $58.3 million at September-end. Alongside its third-quarter 2022 results, management had announced that it will not have sufficient liquidity to maintain its operations beyond January 2023 based on current cash and cash equivalents and Rubraca revenue estimates.

Per management, Clovis has been facing several regulatory setbacks for its cancer drug Rubraca. These setbacks have impacted current revenues and the commercial potential of Rubraca.

Rubraca was also approved in the United States and Europe in the third or later-line setting in ovarian cancer. However, the company has voluntarily withdrawn approval for this indication in both markets. The decision to withdraw is based on data from the ARIEL4 post-marketing study, which linked Rubraca to an increased risk of death. While the approval in the United States was withdrawn with effect from June 2022, it was also withdrawn in Europe from September 2022.

Rubraca is currently approved in the United States and Europe as a second-line maintenance treatment for recurrent ovarian cancer in patients who respond (completely or partially) to platinum-based chemotherapy. Earlier this month, the company also announced that it had revised the drug’s label to treat tBRCA patients only, based on the FDA’s recommendation.

Due to these factors highlighting the uncertain market potential of Rubraca, Clovis is also facing continuing challenges in raising additional capital. In the first nine months of 2022, sales of Rubraca were $97 million, down 14% year over year.

A PARP inhibitor, Rubraca faces stiff competition from Lynparza, another PARP inhibitor jointly developed and commercialized by

AstraZeneca

AZN

and

Merck

MRK

. AstraZeneca/Merck’s Lynparza is approved for four cancer types, namely ovarian, breast, prostate and pancreatic cancers, in various patient populations. Merck and AstraZeneca are evaluating Lynparza across a range of tumor types. In the first nine months of 2022, Lynparza generated product sales of $1.95 billion for AstraZeneca and alliance revenues of $825 million for Merck.

Zacks Rank

Clovis currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report