Shares of

Clovis Oncology, Inc.

CLVS

rallied 19.4% on Jun 15 after management reported initial data from the phase I/II LuMIERE study on FAP-2286, which demonstrates preliminary evidence of activity as a treatment and imaging agent across a wide range of solid tumors.

Data from the first two dose cohorts of the phase I portion of the LuMIERE study showed that nine patients treated with FAP-2286, labelled with lutetium-177 (177Lu-FAP-2286) demonstrated a manageable safety profile and encouraging evidence of activity. A confirmed partial response was also reported in one heavily pre-treated patient who completed six administrations of 177Lu-FAP-2286. In fact, no serious adverse event was observed in the study participants who were treated with 177Lu-FAP-2286.

Management plans to use the data from the phase I portion to determine the recommended dose and schedule in the phase II portion of the LuMIERE study. Clovis plans to start the phase II portion later this year.

The phase I/II LuMIERE study is evaluating the safety, pharmacokinetics, dosimetry and preliminary antitumor activity of FAP-2286 for treating solid tumors. CLVS is currently enrolling participants in the third dose cohort of this study.

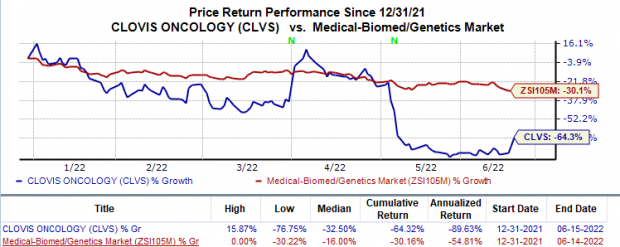

Shares of Clovis have declined 64.3% in the year so far compared with the

industry

’s 30.2% fall.

Image Source: Zacks Investment Research

An investigator initiated phase I study is also evaluating the safety and tumor uptake of FAP-2286 labeled with gallium-68 (68Ga-FAP-2286) as a novel imaging agent to identify metastatic cancer in patients with solid tumors. Clovis plans to use data from the study to begin phase II expansion cohorts for the treatment of multiple tumors by fourth-quarter 2022.

FAP-2286 is the lead candidate in Clovis’ targeted radionuclide therapy development program. Per management, the candidate is also the first peptide-targeted radionuclide therapy (PTRT) and imaging agent targeting fibroblast activation protein (FAP) to enter clinical development. FAP is a promising theranostic target with expression across many types of solid tumors.

Per management, this initial data supports Clovis’ hypothesis that FAP-2286 not only targets the tumor but also avoids off-target tissues. This data supports the potential clinical utility of the candidate to treat advanced solid tumors.

Zacks Rank & Stocks to Consider

Clovis currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Sesen Bio

SESN

. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, both Abeona Therapeutics and Sesen Bio carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 13 cents to 3 cents in the past 60 days. Shares of ALKS have risen 18.8% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 31 cents in the past 30 days. Shares of ABEO have plunged 52% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed on earnings by 25%.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 60 days. Shares of SESN have fallen 22.5% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, Sesen Biodelivered an earnings surprise of 100%.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report