Clovis Oncology, Inc.

’s

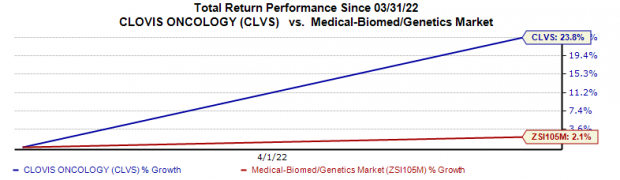

CLVS

shares rallied 23.8% on Apr 1 compared with the

industry

’s 2.1% rise.

Image Source: Zacks Investment Research

The primary reason for the share price increase is attributable to Clovis’ announcement of positive top-line data from the monotherapy arm of the phase III ATHENA study. The study evaluated Rubraca (rucaparib) as a first-line maintenance treatment of ovarian cancer in women who responded to first-line platinum-based chemotherapy.

The monotherapy arm, also called ATHENA-MONO, achieved its primary endpoint of a statistically significant progression free survival (PFS) versus placebo. All patients treated in the ATHENA-MONO arm and administered Rubraca achieved a median PFS of 20.2 months compared to 9.2 months in patients who received placebo.

Clovis also conducted a separate analysis in the ATHENA-MONO arm, which evaluated Rubraca monotherapy in a patient population with homologous recombination deficiencies (HRD-positive), including BRCA-mutant (BRCAm) tumors. Data from the study demonstrated that patients in this group treated with Rubraca achieved a median PFS of 28.7 months in comparison to 11.3 months in those administered placebo.

Based on the above data, CLVS intends to seek label expansion for Rubraca as a first-line ovarian cancer maintenance treatment in both the United States and Europe. In this regard, management plans to file a regulatory application with the FDA and EMA by second-quarter 2022 and third-quarter 2022, respectively.

Clovis also announced PFS endpoint data from two exploratory subgroups, one with patients having HRD-negative tumors and another with patients suffering BRCAm tumors. While patients who were administered Rubraca in the HRD-negative subgroup achieved a median PFS of 12.1 months against the 9.1 months in placebo. The BRCAm subgroup did not reach a median PFS in patients dosed with Rubraca.

CLVS is also evaluating the combination of Rubraca and

Bristol Myers

’

BMY

Opdivo (nivolumab) against Rubraca monotherapy in an independent arm of the ATHENA study (ATHENA-COMBO) for advanced ovarian cancer as a first-line maintenance treatment. Data from the study, which was earlier expected in fourth-quarter 2022, is now awaited in first-quarter 2023, delayed by a quarter due to slower-than-expected event count.

The ATHENA study is part of a broader clinical collaboration with Bristol Myers, formalized in 2017. Opdivo is one of the key drivers of Bristol Myers’s top line. For fiscal 2021, which ended on Dec 31, BMY recorded $7.5 billion from Opdivo sales.

Currently, Rubraca is approved in the United States for two indications specific to ovarian cancer in the second- and third or later-line setting.Apart from ovarian cancer, Rubraca is approved in the United States under the accelerated approval as a monotherapy for treating BRCAm metastatic castrate-resistant prostate cancer (mCRPC).

Clovis is currently evaluating Rubraca in a broad development program across different solid tumors. CLVS is looking to expand Rubraca’s label into additional cancer types like breast and gastroesophageal cancers among others.However, Rubraca’s target market is highly competitive. The medicine faces stiff competition from Lynparza, another PARP inhibitor, jointly developed and commercialized by both

AstraZeneca

AZN

and

Merck

MRK

.

Overall, AstraZeneca/Merck’s Lynparza is approved for four cancer types, namely ovarian, breast, prostate and pancreatic cancers, in various patient populations. Merck and AstraZeneca are evaluating Lynparza across a range of tumor types.

For 2021, Lynparza generated product sales of $2.35 billion for AstraZeneca and alliance revenues of $989 million for Merck.

Zacks Rank

Clovis currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report