When thinking of legendary rivals, PepsiCo

PEP

and The Coca-Cola Company

KO

undoubtedly come to the forefront of many minds.

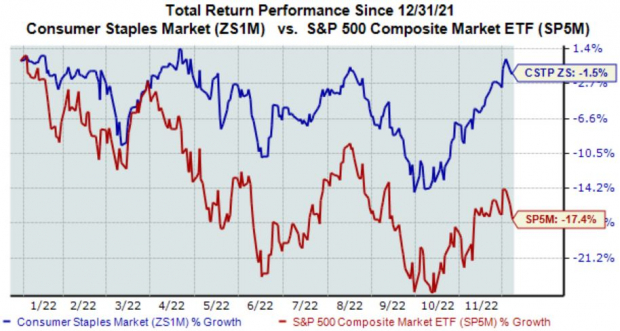

After all, they’re both titans in the Zacks Consumer Staples sector, which has performed at a much higher level than the general market in 2022. This is shown in the chart below.

Image Source: Zacks Investment Research

With similar product catalogs, it raises a valid but potentially tricky question – which company’s shares currently appear more attractive?

Let’s take a deeper dive to get a more evident answer.

Share Performance

By looking at each company’s share performance, we can see which has seen more bullish action and which investors have preferred to buy.

From a longer-term perspective (last five years), PEP shares have tacked on nearly 80% in value vs. KO’s nearly 65% gain. Still, both performances have outpaced the S&P 500’s gain of roughly 63% in the same timeframe.

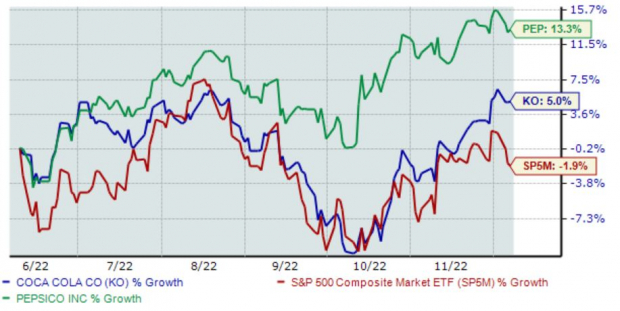

Image Source: Zacks Investment Research

Upon shrinking the timeframe to encompass just the last six months of price action, we can see that PEP shares have again outperformed KO shares, up more than 13% vs. Coca-Cola’s 5% gain.

Image Source: Zacks Investment Research

While PepsiCo shares have been stronger across several timeframes, both stocks have provided market-beating returns, undoubtedly a major positive.

Valuation

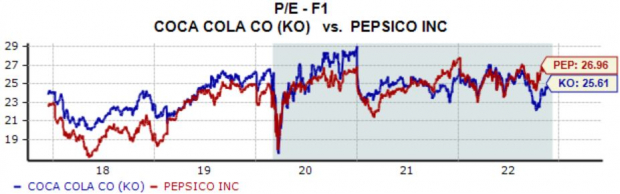

Of course, valuation must always be addressed. Currently, PEP shares trade at a 26.9X forward earnings multiple, whereas KO shares currently trade at a 25.6X forward earnings multiple.

Image Source: Zacks Investment Research

Both values reside above their respective five-year medians and the S&P 500 average, indicating that investors will pay a premium for shares of both companies. Still, KO shares are slightly cheaper than PEP shares.

Dividends

Dividends provide a solid boost to any portfolio, limiting the impact of drawdowns and providing a passive income stream.

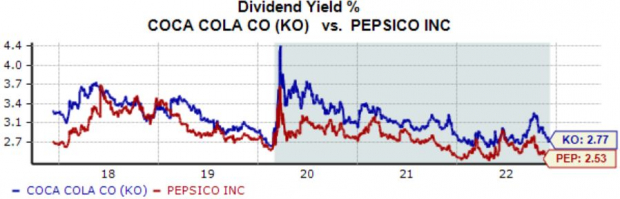

Impressively, KO and PEP are both Dividend Kings, showing an unparalleled commitment to their shareholders through 50+ consecutive years of increased dividend payouts.

Currently, PepsiCo’s annual dividend yields 2.5% vs. KO’s 2.8%, a modest difference.

Image Source: Zacks Investment Research

However, there’s a notable difference regarding each company’s dividend growth; PEP’s 6.5% five-year annualized dividend growth rate handily outpaces KO’s 3.1%.

Growth Outlook

Undoubtedly important is the growth trajectory of each company. After all, if a company isn’t growing, why would an investor want to buy?

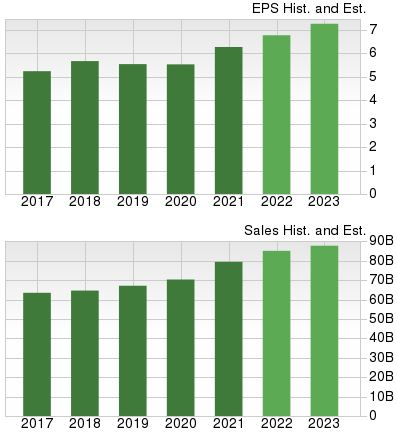

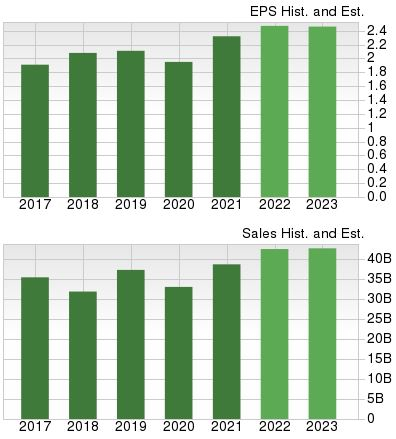

Currently, the Zacks Consensus EPS Estimate for PepsiCo’s current fiscal year (FY22) indicates Y/Y growth of roughly 8%. And in FY23, earnings are forecasted to tack on a further 7.3%.

Image Source: Zacks Investment Research

Regarding Coca-Cola, earnings are forecasted to climb 6.5% in its current fiscal year (FY22) but decline a marginal 0.4% in FY23.

Image Source: Zacks Investment Research

PepsiCo undoubtedly wins this round, with forecasted earnings growth for both its current and next fiscal year.

Bottom Line

The Coca-Cola Company

KO

and PepsiCo

PEP

are undoubtedly titans in the Zacks Consumer Staples sector, with market caps north of $200 billion.

Still, with similar operations, investors may be left wondering which company’s shares would provide a better bang for their buck.

In this heavyweight battle, PepsiCo appears to come out on top. Here’s why: the company carries stronger dividend growth, a more robust earnings outlook, and PEP shares have been visibly stronger across several timeframes.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.

>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report