Ford’s recent performance:

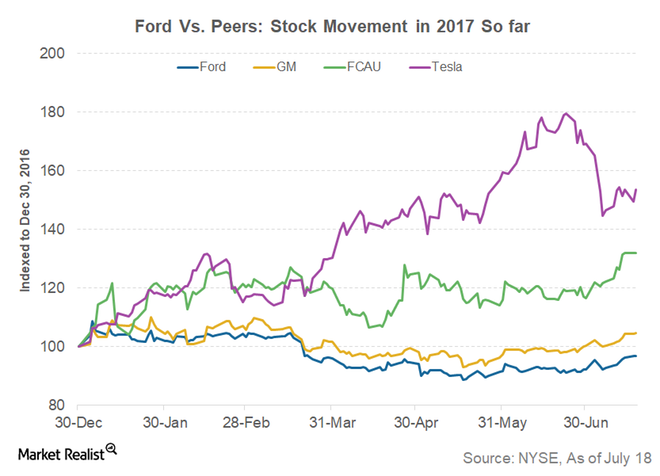

For the past 4 quarters, Ford has underperformed relative to its peer group, and the general market. There is room for optimism, however, as July 2017 has seen Ford Motor Company (NYSE:$F) trading in the positive.

As of July 18th, Ford has risen ~5.0% month-to-date, while its peers General Motors (NYSE:$GM), and Fiat Chrysler (NYSE:$FCAU) have appreciated 4.3% and 13.1% respectively.

Being one of the largest US auto companies, second only to General Motors (NYSE:$GM), all eyes will be on Ford when the company releases its 2Q17 earnings results on the 26th of July.

However, to understand the true market sentiment and to form opinions for yourself, let’s take a look at Ford’s historical performance before it’s 2Q estimates.

Recent Trends and Performance

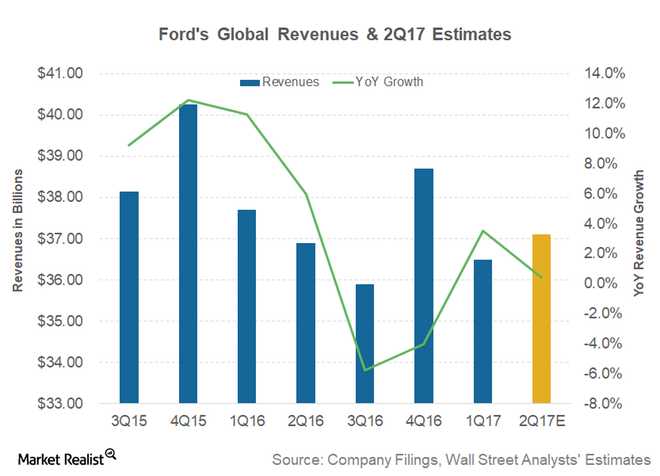

Reporting revenues of $36.5 billion in 1Q17, Ford not only increased their topline by 3.5% from the same quarter last year, but also beat analyst estimates of $34.7 billion.

Overall, US auto demand heavily lagged in the first half of 2017, which also throws future consumption into question. If these trends continue, Ford could face industry headwinds, which may be a core reason why only 28% of analysts have issued a “buy” rating on its stock.

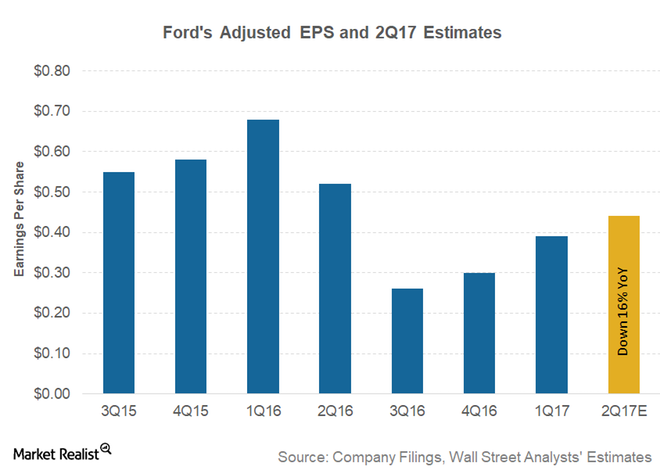

Additionally, Ford has seen tightening margins on its Truck segment unlike its peers, General Motors, Fiat Chrysler, and Toyota (TYO:$7203). Despite still beating analyst estimates, Ford’s 1st quarter earnings were reflected, as they posted adjusted EPS (Earnings Per Share) of $0.39, which is approximately a 43% decrease from the $0.68 reported in 1Q16.

2Q17 Estimates

Unfortunately, analysts expect the continuance of these negative trends to affect Ford throughout 2017.

Analysts expect Ford to grow its topline by about ~0.4%, from 2Q16 revenues of $36.9 billion to 2Q17 revenue estimates of $37.1 billion.

While analysts are optimistic of Ford’s top-line growth, falling margins may have attributed to low earnings expectations. EPS has been estimated to be about $0.44 in 2Q17, which represents a decline of ~16.1% from adjusted EPS of $0.52 for 2Q16.

Management has also weighed in with earnings guidance. Although Ford experienced headwinds in the international markets in 2016, the European markets saw improvement in 4Q16, and 1Q17 to make up.

As of July 18, 2017, the consensus 12-month price target for Ford is $12.75. At a market price of ~$11.75, this represents a 9% upside.

Featured Image: depositphotos/blinow61