While investors are often told not to flock to popular or high-performing stocks due to market volatility, betting against such stocks could also result in the investor to miss out on good profits. One current example is Tesla, Inc. (NASDAQ:$TSLA), a high-performing stock that investors continue to have a bearish view of.

S3 Partners, a financial analytics firm, has reported Tesla to be the largest shorted stock in the U.S. equity market, with short interest of $10.4 billion. However, Tesla’s shares have been going strong, up 65.4% year-to-date.

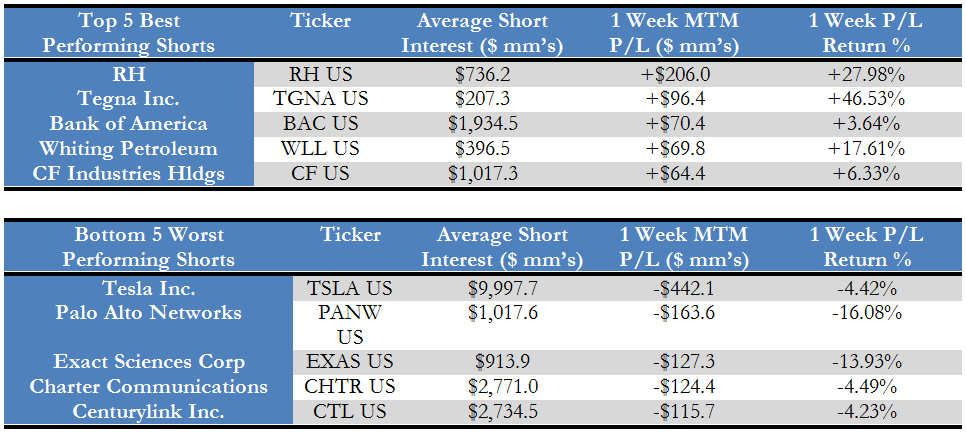

Short investors are now losing more money: for the week ending June 2, 2017, investors that bet against Tesla have a total mark-to-market loss of $422 million, making it the worst performing stock for short investors two weeks in a row. Year-to-date, losses by short investors have gone above $5 billion.

Upgrades A Detriment to Shorts

News of another upgrade of Tesla’s highly-anticipated Model 3, the electric car that has been widely-marketed and gaining more and more attention from the public, caused short investors of the company to experience bigger-than-usual losses last week. Betting against Tesla continues to be a bad idea, as they seem to be gaining traction by being bold and different. “From an automotive perspective, they’re doing something no one else is able to do in the industry right now,” James Albertine, a senior analyst at Consumer Edge Research, told CNBC.

Long-term success for Tesla seems to undeniable, as Schaffer’s Research, a private provider of investment recommendations and research, has increased its price target for the company to $368 per share, with a peak that could hit $500 per share after the launch of Model 3.

Winners

Short investors in Tesla are definitely in a bad place right now compared to investors that betted against companies such as Restoration Hardware (NYSE:$RH) and Bank of America Corp. (NYSE:$BAC).

Short sellers gained the most from Restoration Hardware in the week ending June 2, 2017, making a market-to-market profit of $206 million. However, short sellers are beginning to take profits, noted S3. While short interest has been up 44% this year ($187 million) in Restoration Hardware, shorts have also been covering — buy to covers just in the last month was $228 million.

“After RH’s recent sharp decline, short sellers may be looking to realize some of their recent profits and exit their short positions, which are still down over 50 percent for the year,” added S3 Partners.

Meanwhile, the fall of Bank of America’s shares after CEO Brian Moynihan cautioned investors of the a potential dip in trading revenues in the near future caused the returns of short sellers to rise 3.64% in the week ending June 2, 2017.

The Takeaway

For investors who want to continue to bet against Tesla, it does not seem like the results of short selling Tesla’s stocks will change any time soon. Last week, Tesla’s shares rose 4.6% (May 29th-June 2nd), and this week shares have risen 6.7% as of Thursday, June 8th.

Featured Image: twitter