As one of the fastest growing sectors in the market, there are a number of investors looking to start investing in technology. If you find yourself in a similar situation, you might want to consider adding Netflix (NASDAQ:$NFLX) or Facebook (NASDAQ:$FB) to your investment portfolio. Both companies are high-growth tech leaders and to no one’s surprise, the stocks have been thrashing the market as of late since both companies have illustrated attractive momentum.

The question that remains is, which company is a better buy?

Facebook maintains operating dominance.

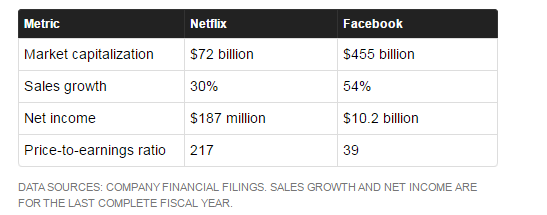

When considering operating metrics, Facebook is by far the stronger company. Even though sales growth is considerably low right now, revenue still improved by 49% last quarter.

Like operating metrics, Facebook leads the pack in regards to profitability. Currently, Facebook’s operating margin lingers around 40% of sales. At the same time, Netflix’s operating margin remains at 4%. Plus, Facebook generated roughly $12 billion of free cash flow in 2016, while Netflix is blowing cash at a $2 billion annual pace.

According to Facebook officials, video will improve user interaction as well as increase value for its advertisers and marketers over the next couple years. Essentially this should help Facebook continue posting successful ad growth. That said, it’s unlikely that ad growth will be close to the 54% pace it managed in 2016. Still, when taking into consideration Facebook’s earning power, cash flow, and sales, investors interested in technology investing will most likely have a preference for the social media company.

Netflix has a massive growth opportunity ahead.

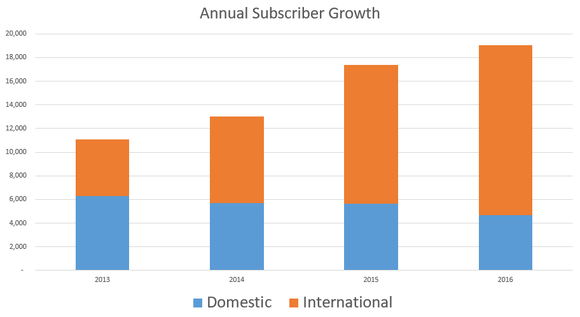

One of the main reasons that investors should consider buying Netflix is because it has a massive growth opportunity ahead. While Facebook already counts more than 1 billion active users around the world and has business outside of the United States, Netflix has only recently formed a presence in the international market. This growth in the international market has allowed for Netflix to obtain an increase in subscriber gains in 2016. Plus, the proportion of international subscribers is coming up, but it hasn’t passed 50%.

Right now, Netflix isn’t producing real profits from its international sector, as it has chosen to invest all extra earnings into further growth, such as building up local content and the brand as well as improving the service so consumers recognize it as the number one streaming video provider. Therefore, Netflix has a lot of similarities to how Facebook was in 2012 when it had zero profits and no free cash flow due to excess spending and preparing for the shift to mobile-first usage.

Though Netflix is not on the same path to success as Facebook, the California-based company still has promising growth prospects. According to Netflix officials, internet TV is still in infancy, even in the United States market which is considered to be quite mature. Officials predict that Netflix can climb to 90 million users over time in comparison to their 49 million users right now.

In regards to earnings, Reed Hastings, the CEO of Netflix, is taking the necessary steps so that Netflix’s operating margin doubles to 7% in 2017. This increase is happening without the help of the international sector, which is close to passing 50 million subscribers.

Investors will see over the next few years that these markets are going to start climbing towards the United States sector’s 40% margin. This climb will make Netflix the more profitable business. If you’re thinking about making a technology investment and you believe that Facebook is as big as it’s going to get, then Netflix might just be the stock for you.

Featured Image: Depositphotos/© alexey_boldin