Thanks to high-performing stocks of giant tech companies Facebook, Amazon, Netflix, and Google (now Alphabet Inc.) — also known as FANG stocks — the technology sector of the market has been in the lead of the market rally this year. In particular, PowerShares QQQ, or the Nasdaq-100 Index Tracking Stock, has rose by an impressive 21.1% year-to-date. Compared to the 9.1% gain for the broader market fund SPY, and the 7.3% for DIA, PowerSharesQQQ has been doing extremely well.

Product growth of the technology continues to be strong, as things continue to improve and be implemented. This includes areas such as cloud computing, big data, Internet of Things, wearables, drones, virtual reality devices, artificial intelligence, and more. Along with product growth, improvement of global fundamentals, solid corporate earnings, rising interest rates, as well as Trump’s proposed corporate tax reform have all played a part in the high rising stocks in the technology sector.

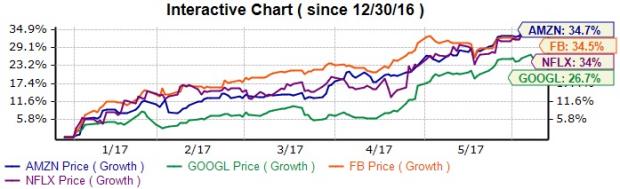

FANG stocks specifically have gained more than an average of 30% year-to-date, with Amazon (NASDAQ:$AMZN) and Alphabet Inc. (NASDAQ:$GOOGL) joining the $1,000 club just recently. Since the shares of Berkshire Hathaway’s Class A (NYSE:$BRK-A), Seaboard Corp. (AMEX:$SEB), NVR Inc. (NYSE:$NVR), and Priceline (NASDAQ:$PCLN), Amazon is the fifth and Alphabet is the sixth company to have a quadruple number as its share price.

.

For Amazon, its success this year (a 34.7% rise) is thanks to steady e-commerce sales as well as its recently developed cloud computing business, Amazon Web Services. Amazon is also looking to make moves into media, advertising, and other popular services with purchases of trucks and designing drones, leases on planes, and building of air cargo hubs.

For Alphabet Inc., its 26.7% rise in share price is thanks to continued increasing usage of Youtube, Google Play, and Google search. As well, the tech company is eyeing emergence markets with high potential by growing products in artificial intelligence, fiber networks, and self-driving vehicles.

Amazon versus Alphabet

So which of these two strong stocks should you invest in? Both have a Growth Style Score of A, which suggest that they will be looking at even more strong growth in the future. It all depends on your investment style and what you prefer.

Alphabet is currently trading at cheaper levels with its price earning ratio (P/E ratio) of 29.14 compared to Amazon’s 153.71. As well, according to ranking by Zacks, a professional provider of securities research, Alphabets ranks #2 in Buy rating, and ranks in the top 26% with an average target price of $1042.36. Company earnings are projected to go up 23.41% this year, compared to the industry average of 30.51%. However, revenues for Alphabet Inc. is expected to increase 19.45%, which is much higher than the expected industry growth of 5.65%. 92% of Zacks analysts have a Strong Buy or Buy rating on the company.

Amazon ranks #3 in Hold rating, according to Zacks, and is ranked in the top 23% — with an average target price of $1056.13 — compared to Alphabet’s 26% in Zacks Industry Rank. Both earnings and revenues are expected to be higher than average industry growth: Amazon’s earnings is projected to rise 34.1% compared to the industry average of 20.82%, and its revenues is expected to go up 22.2% compared to industry average 4.59%. 80.6% of Zacks analysts have a Strong Buy or Buy rating on the company.

ETFs to Bet On

With relatively cheap valuation and a #2 in Zacks Rank, Alphabet looks a bit more solid as an investment. The investment can be done in many ways, one of which is betting on Alphabet Inc. in a basket form with ETFs such as iShares U.S. Technology ETF ($IYW), Select Sector SPDR Technology ETF (XLK), and MSCI Information Technology Index ETF ($FTEC). Alphabet has a 6.47% share in IYW, 5.56% share in XLK, and a 5.2% share in FTEC; year-to-date, the funds have risen 22.6%, 19.2%, and 21.7%, respectively. XLK tends to be more popular amongst investors due to its wide-range exposure of the broad tech industry.

However, with an expected higher than average industry growth in earnings and revenues, some investors might want to consider investing in Amazon. As such, investors can invest through ETFs such as VanEck Vectors Retail ETF ($RTH), Consumer Discretionary Select Sector SPDR Fund ($XLY), and Fidelity MSCI Consumer Discretionary Index ETF ($FIDS). Amazon holds top shares in all three of these ETFs. Year-to-date, RTH has gained 9.5% while both XLY and FDIS rose 11.8%. XLY tends to be more popular amongst investor thanks to its liquid assets under management (AUM) of $12.8 billion.

With the success rate and no real clear indication of which one can help investors reap the most profit, other investors might want to invest in both Google and Amazon. Investors who want to invest both should consider First Trust Dow Jones Internet Index ($FDN), PowerShares QQQ ($QQQ), and the First Trust Cloud Computing ETF ($SKYY). For FDN, Amazon holds 8.9% of shares while Alphabet holds 5.25%. In QQQ, Amazon holds a 7.1% share and Alphabet holds 4.4%, while in SKYY Amazon holds 5.2% shares while Alphabet holds 4.9%. Year-to-date, FDN has rose 22.2%, QQQ 17.1%, and SKYY 21.4%.

Featured Image: facebook