After Amazon’s announcement of their intent to acquire Whole Foods on Friday, Walmart (NASDAQ:$WMT) shares plunged by more than 6%.

However, while Amazon was looking to increase their physical footprint, retail giant Walmart has been strategizing around its e-commerce presence in order to compete with Amazon in the online retail space. This is confirmed by UBS analyst reports, as Walmart has increased its stock keeping units (SKUs) more than 5 times, from around 10 million seen just last year, to current levels of 50 million.

In Walmart’s latest effort to accelerate its online retail presence, they announced their intent to purchase Bonobos, a menswear brand built off of e-commerce for $310 million cash. According to eMarketer, since its online debut in 1994, Walmart is now the third largest e – commerce retailer in America. However, with Amazon’s online sales of $94.7 billion, Walmart’s $1.4 billion greatly pales in comparisons.

A Paved Path for Walmart

Brendan Witcher, principal analyst at Forrester Research told Yahoo Finance, “It (Walmart) used to take offline strategies and philosophies and try to apply them online.”

Continuing, Brendan Witcher adds, “Walmart has traditionally been … a laggard in the space of online”. This might be because, “It used to take offline strategies and philosophies and try to apply them online.”

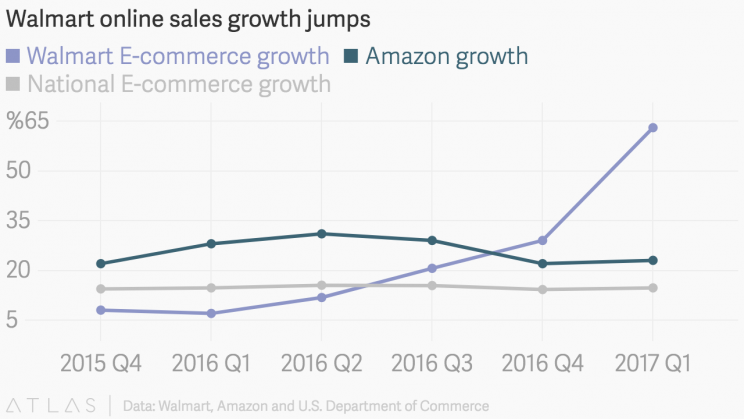

By targeting companies that have already succeeded in particular areas, Walmart has closed the gap through strategic acquisitions. Coming off of slow growth in 2015, In August 2016, Walmart agreed to buy e-commerce startup Jet.com for $3.3 Billion. This move not only brought in crucial e-commerce optimization, but also saw its founder Marc Lore appointed to manage Walmart.com.

In order to compete with Amazon Prime’s 2 day delivery (which requires a membership of $99), Walmart announced in January that it would offer free two day shipping for purchases above $35. This change in shipping terms attributed to a 63% influx in Walmart’s online sales observed in first quarter 2017 earnings.

Brendan Witcher believes that the retail giant is starting to get e-commerce right, and heading in the right direction to improve online customer experience. “Walmart continued to announce doing things that other retailers have been doing for a while and successfully. By being the laggard, they almost have a blueprint for how to do e-commerce well,”

Some Only Use Walmart.com As A Catalog

Although boasting double digit growth in recent quarters, and billions invested, Walmart’s online sales still make up just 3% of its total revenue. As such, Walmart announced in October that they are slowing down new store openings in order to focus on their online strategies.

There are certain people however, that only use Walmart’s website as a catalog to check whether or not their items are available in store. These consumers then typically travel to their nearest Walmart to purchase their items, voiding the need to wait for shipping.

In order to attract this segment of consumers who are used to picking up in store, Walmart is trying to take advantage of both purchasing forums in order to provide convenience and exposure. In April, Walmart announced discounts on products for online shoppers who pick up orders in stores.

During a media call last may, Walmart CFO Brett Biggs commented, “We want customers shopping at Walmart, whether that’s in stores, whether that’s in pick-up, whether that’s getting things delivered to their homes – we see the different ways that we allow the customer to do that so we look at it more holistically than that.”

As Amazon’s decision to buy Whole Foods was a move likely to compete with Walmart, it seems to be a response to Walmart’s growing online integration. Being one of the largest grocery retailers in North America, Walmart must increase its online presence and overall sales strategy in order to compete with Amazon in the near future.

Featured Image: twitter