CRISPR Therapeutics

CRSP

is a leading gene-editing company focused on developing CRISPR/Cas9-based therapeutics for the treatment of hemoglobinopathies, cancer, diabetes and other diseases.

CRSP is focused on developing its gene-editing pipeline. CRISPR Therapeutics’ lead pipeline candidate is CTX001 — an investigational ex-vivo CRISPR gene-edited therapy for treating sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT) — in partnership with

Vertex Pharmaceuticals

VRTX

. CTX001 is currently being evaluated in two separate phase III studies, CLIMB THAL-111 and CLIMB SCD-121, for treating TDT and severe SCD, respectively. Target enrolment in both the studies is already achieved and more than 75 patients have been dosed across both studies to date.

CRISPR Therapeutics and Vertex Pharmaceuticals anticipate a regulatory filing for the therapy for both indications later this year.

Both SCD and TDT have a significant unmet medical need, and if successfully developed and commercialized, CTX001 can provide a huge boost to CRISPR Therapeutics’ prospects. CRSP, along with Vertex Pharmaceuticals, initiated two new phase III studies of CTX001 in pediatric patients with SCD and TDT.

Both CRSIPR Therapeutics and Vertex Pharmaceuticals are also working on developing therapies to address cystic fibrosis as well as Duchenne Muscular Dystrophy (DMD) and Myotonic Dystrophy Type 1 (DM1). We note that CRSP’s top line primarily comprises collaboration revenues and milestone payments received from VRTX.

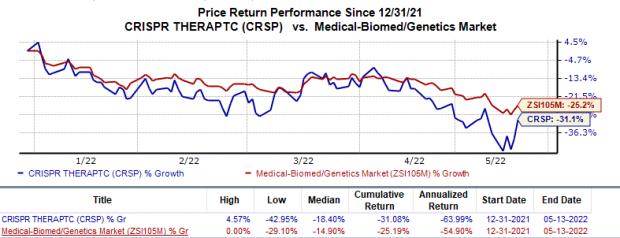

Shares of CRSP have plunged 31.1% so far this year compared with the

industry

’s 25.2% decline.

Image Source: Zacks Investment Research

Apart from its lead candidate, CRISPR Therapeutics is developing other candidates in its pipeline. CRSP is currently evaluating three chimeric antigen receptor T cell (CAR-T) therapy candidates, namely CTX110, CTX120 and CTX130, which target hematological and solid-tumor cancer indications.

CRSP is currently evaluating CTX110 in a pivotal phase I CARBON study to treat relapsed/refractory B-cell malignancies. CRISPR Therapeutics is expected to report additional data from this study later this year.

An ongoing phase I study is evaluating the safety and efficacy of several dose levels of CTX120 for the treatment of relapsed or refractory multiple myeloma. Two independent ongoing phase I studies are also evaluating the safety and efficacy of several dose levels of CTX130 for treating solid tumors and certain hematologic malignancies. Updates from both these candidates are expected in first-half 2022.

CRSP also advanced its first program incorporating stem-cell therapy for the treatment of diabetes in partnership with ViaCyte. The first patient is already dosed in a phase I study to evaluate the safety, tolerability and immune evasion of VCTX210 for type I diabetes (T1D).

With no approved products in its commercial portfolio, CRISPR Therapeutics lacks a source of regular income. Failure in the ongoing studies will hurt the stock significantly. While CRSP’s lead candidate is still a couple of years away from commercialization, other pipeline candidates are several years away from the same stage. Moreover, CRSP’s dependence on VRTX for collaboration revenues is worrisome, as termination of their mutual contract in the near future would adversely impact the stock’s prospects .

Zacks Rank & Key Picks

CRISPR Therapeutics currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector are

Alkermes

ALKS

and

Sesen Bio

SESN

, each currently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 13 cents to 3 cents in the past 30 days. Shares of ALKS have risen 15.6% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 30 days. Shares of SESN have declined 46.9% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report