CRISPR Therapeutics AG

CRSP

reported fourth-quarter 2021 net loss per share of $1.84, wider than the Zacks Consensus Estimate of a loss of $1.74. The company posted earnings per share of $1.50 in the year-ago period.

CRISPR Therapeutics’ total revenues, which comprise grants and collaboration revenues, came in at $12.9 million for the fourth quarter compared with $0.4 million reported in the year-ago period. The rise in revenues was attributable to a milestone payment of $12.3 million received from

Vertex Pharmaceuticals

VRTX

upon attaining a research milestone in the Myotonic Dystrophy Type 1 (DM1) program. The top line also substantially beat the Zacks Consensus Estimate of $5.4 million.

We note that the company is solely dependent on Vertex Pharmaceuticals for collaboration revenues.

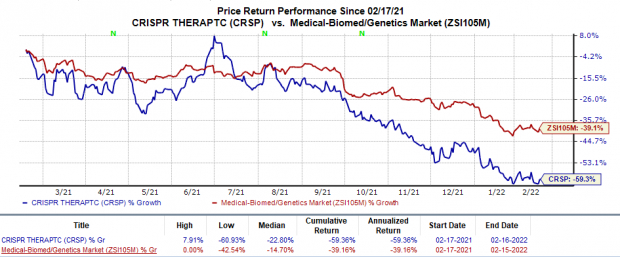

Shares of CRISPR Therapeutics have plunged 59.4% so far this year compared with the

industry

’s 39.2% decline.

Image Source: Zacks Investment Research

Quarter in Detail

For the reported quarter, research and development expenses were $134.5 million, up 63.3% from the year-ago figure due to increased headcount expenses and development costs for advancing the hemoglobinopathies and immuno-oncology programs.

General and administrative expenses declined 6.4% year over year to $24.1 million.

As of Dec 31, 2021, the company had cash, cash equivalents and marketable securities of $2.4 billion compared with $2.5 billion as of Sep 30, 2021.

Full-Year Results

For 2021, CRISPR Therapeutics generated revenues of $915 million, reflecting a substantial rise year over year due to collaboration revenues from Vertex Pharmaceuticals.

For the same period, the company reported earnings of $4.70 per share against the year-ago loss of $5.29.

Pipeline Updates

CRISPR Therapeutics is developing CTX001 — an investigational ex-vivo CRISPR gene-edited therapy for treating sickle cell disease and transfusion-dependent beta thalassemia — in partnership with Vertex Pharmaceuticals. The candidate is currently in development in a phase I/II study. Target enrolment in both the studies has been achieved and regulatory submission for the therapy in both indications is anticipated by 2022-end.

Apart from CTX001, CRISPR Therapeutics is also developing three chimeric antigen receptor T cell (CAR-T) therapy candidates — CTX110, CTX120, and CTX130 — for the treatment of hematological and solid-tumor cancers.

The company is currently evaluating CTX110 in phase I CARBON study for the treatment of relapsed/refractory B-cell malignancies. Alongside its Q4 earnings release, CRISPR Therapeutics also announced that it has expanded the ongoing phase I CARBON study into a pivotal one and has implemented consolidation dosing in patients. The company is expected to report additional data from this study later this year.

A phase I study is investigating the safety and efficacy of several dose levels of CTX120 for the treatment of relapsed or refractory multiple myeloma. Two independent ongoing phase I studies are also evaluating the safety and efficacy of several dose levels of CTX130 for treating solid tumors and certain hematologic malignancies. Top-line data from both the studies is expected in first-half 2022.

This apart, CRISPR Therapeutics, along with partner ViaCyte, dosed the first patient in a phase I study to evaluate the safety, tolerability, and immune evasion of VCTX210 in type I diabetes.

Zacks Rank & Stocks to Consider

CRISPR Therapeutics currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the drug/biotech sector include

Adaptimmune Therapeutics

ADAP

and

Theravance Biopharma

TBPH

, each carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Adaptimmune Therapeutics’ loss per share estimates for 2022 have narrowed from 99 cents to 91 cents in the past 30 days.

Earnings of Adaptimmune Therapeutics beat estimates in three of the last four quarters and missed the mark on one occasion, with the average surprise being 0.9%.

Theravance Biopharma’s earnings per share estimates for 2022 have increased from 47 cents to 48 cents in the past 30 days.

Earnings of Theravance Biopharma beat estimates in three of the last four quarters and missed the mark on one occasion, with the average surprise being 7.3%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report