Deciphera Pharmaceuticals, Inc.

DCPH

reported third-quarter 2021 loss of $1.37 per share, wider than the Zacks Consensus Estimate of a loss of $1.29 and the year-ago quarter’s loss of $1.13. The loss can be attributed to increased research and development (R&D) expenses.

Total net revenues were $23.2 million in the quarter, narrowly missing the Zacks Consensus Estimate of $23.7 million. However, revenues rose 50.3% year over year.

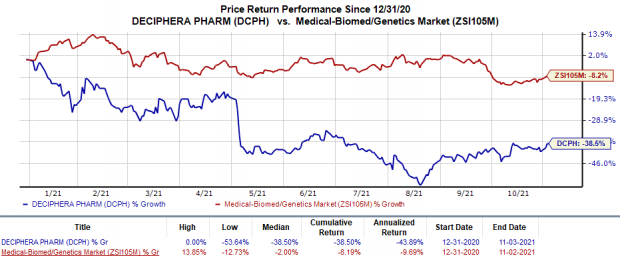

Shares of the company have lost 38.5% in the year so far compared with the

industry

’s decline of 8.2%.

Image Source: Zacks Investment Research

Quarter in Detail

In May 2020, Qinlock was approved by the FDA to treat adult patients with advanced gastrointestinal stromal tumors (GIST) who have received prior treatment with three or more kinase inhibitors, including imatinib.

Apart from Qinlock, there are no other marketable drugs in the company’s pipeline. Total revenues comprised net product revenues and collaboration revenues. Net product revenues were $21.7 million, including $20 million in U.S. sales and $1.7 million in ex-U.S. sales.

Collaboration revenues of $1.5 million comprised commercial supply and royalty revenues under the company’s license agreement with

Zai Labs

ZLAB

. In March 2021, the company collaborated with Zai Labs to commercially launch Qinlock in China to treat adult patients with fourth-line GIST.

Research and development expenses were $66.4 million, up 35% year over year. The increase was attributed to personnel and preclinical costs as well as increased clinical costs related to start-up activities for the planned phase III MOTION study on vimseltinib and phase Ib/II study on Qinlock combined with binimetinib. The company also made an upfront payment of $4 million to Sprint Bioscience for in-licensing the global rights to the research program targeting VPS34.

Selling, general and administrative expenses were $35.5 million, up from $30.1 million in the year-ago quarter due to personnel costs as well as external spend related to professional fees, including those associated with establishing a targeted commercial infrastructure in key European markets to support a potential launch of Qinlock in Europe, if approved.

Deciphera had cash, cash equivalents and investments worth $392.2 million as of Sep 30, 2021, down from $451 million as of Jun 30, 2021.

Pipeline Updates

The company is currently evaluating Qinlock compared to sunitinib in phase III INTRIGUE study in patients with second-line GIST.Top-line results from the INTRIGUE study are expected in the fourth quarter of 2021.

Deciphera also plans to initiate a phase Ib/II study of Qinlock in combination with Mektovi (binimetinib) in post-imatinib GIST patients in fourth-quarter 2021.

Last month, the company announced the receipt of approval in Switzerland for Qinlock in fourth-line GIST. A potential European Medicines Agency (EMA) approval for Qinlock in fourth-line GIST is expected in fourth-quarter 2021. Earlier in September, the EMA’s Committee for Medicinal Products for Human Use rendered a positive opinion, recommending approval for Qinlock to treat the given indication.

Zacks Rank & Stocks to Consider

Deciphera currently carries a Zacks Rank #4 (Sell). A couple of better-ranked stocks in the same sector are

Alkermes

ALKS

and

Regeneron Pharmaceuticals

REGN

, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ earnings per share estimates for 2021 have increased from 61 cents to 68 cents in the past 60 days. The same for 2022 has risen from $1.06 to $1.11 in the past 60 days. The stock has rallied 48.9% so far in the year.

Regeneron’s earnings per share estimates for 2021 have risen from $54.15 to $62.36 in the past 60 days. The same for 2022 has climbed from $44.11 to $46.69 over the same period. The stock has rallied 32.2% so far this year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report