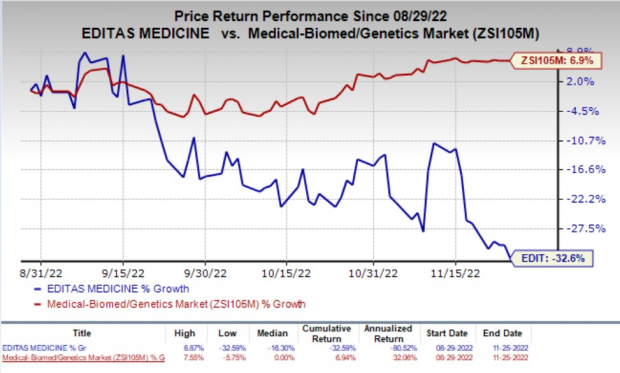

Shares of

Editas Medicine, Inc.

EDIT

have plunged 32.6% in the past three months against the

industry

’s increase of 6.9%.

The company is developing its lead pipeline candidate, EDIT-101, which employs CRISPR gene editing to treat Leber congenital amaurosis type 10 (LCA10), a rare genetic illness that causes blindness.

Image Source: Zacks Investment Research

In November 2022, EDIT announced data from the phase I/II BRILLIANCE study, EDIT-101, for treating blindness due to LCA10. The study included safety and efficacy data from all 14 patients (12 adults and two pediatric patients) who were being treated for LCA10.

Data from the study showed that three out of 14 subjects who were treated met a responder threshold, having experienced clinically meaningful improvements in best-corrected visual acuity. Treatment with EDIT-101 was tolerated with no ocular serious adverse effects or dose-limiting toxicities reported.

Overall, the study achieved proof of concept and identified a responder population. However, two of the three responders were homozygous for IVS26 mutation, as concluded after an examination of baseline characteristics of the treatment responder patients. According to Editas, LCA10 patients homozygous for CEP290 IVS26 mutation is a small patient population of 300 in the United States.

Owing to this small patient population, which is expected to respond to the therapy, Editas decided to pause enrollment in the BRILLIANCE study. EDIT decided not to proceed with this program independently and actively seek a collaboration partner to continue the further development of EDIT-101.

This can be attributed to the reason for the stock remaining down during this period.

It remains to be seen whether Editas will eventually get a partner for developing EDIT-101 in the days ahead and what is the next path forward in case it does not get one.

This apart, Editas’ other pipeline candidates are progressing well.

The company is evaluating the safety and efficacy of its investigational gene-editing medicine, EDIT-301, for treating sickle cell disease.

Initial preliminary data from the RUBY study is expected to be presented by 2022-end.

Editas is also planning to begin the phase I/II EDITHAL study to evaluate EDIT-301 for treating transfusion-dependent beta thalassemia patients. Dosing in the study is expected to begin shortly.

In the absence of an approved product in its portfolio, pipeline development remains in key focus for Editas. However, setbacks related to EDIT-101 will be detrimental to the company and might adversely affect the stock in the days ahead.

Zacks Rank & Other Stocks to Consider

Editas currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks worth considering in the biotech sector are

ASLAN Pharmaceuticals Limited

ASLN

,

Immunocore Holdings plc

IMCR

and

Angion Biomedica Corp.

ANGN

, all carrying a Zacks Rank #2 at present.You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Loss per share estimates for Immunocore have narrowed 39.7% for 2022 and 39.4% for 2023 in the past 60 days.

Earnings of Immunocore surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. IMCR witnessed an earnings surprise of 68.34% on average.

Loss per share estimates for Angion Biomedica have narrowed 6.1% for 2022 and 3.9% for 2023 in the past 60 days.

Earnings of Angion Biomedica surpassed estimates in three of the trailing four quarters and missed the mark on the other occasion. ANGN witnessed an earnings surprise of 66.42% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report