Editas Medicine, Inc.

EDIT

incurred a loss of 74 cents per share in the first quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of 81 cents. The company had reported a loss of 86 cents per share in the year-ago quarter.

Collaboration, and other research and development revenues, comprising the company’s top line, came in at $6.8 million in the reported quarter compared with $6.5 million in the year-ago quarter. The top line also beat the Zacks Consensus Estimate of $5 million.

In the first quarter of 2022, research and development expenses were $38 million, down 9.3% from the year-ago figure. General and administrative expenses decreased 8.8% to $19.5 million owing to lower professional service expenses.

Editas had cash, cash equivalents and investments worth $566.4 million as of Mar 31, 2022, compared with $619.9 million as of Dec 31, 2021.

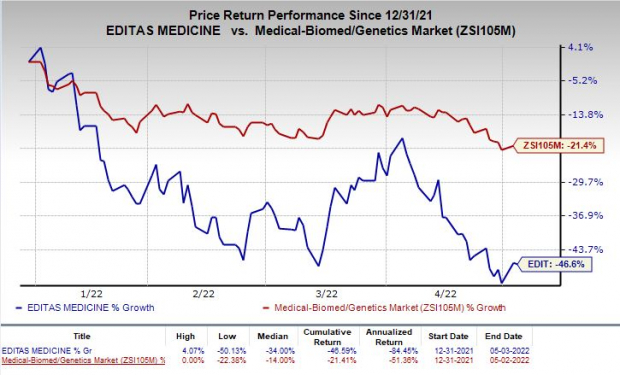

Shares of Editas have plunged 46.6% in the year so far compared with the

industry

’s decrease of 21.4%.

Image Source: Zacks Investment Research

Pipeline & Other Updates

Editas has no approved product in its portfolio at the moment. Therefore, pipeline development remains in key focus for the company.

The company is developing its lead pipeline candidate, EDIT-101, which employs CRISPR gene editing to treat Leber congenital amaurosis type 10 (LCA10) — a rare genetic illness that causes blindness.

Last month, Editas dosed the first pediatric patient in the phase I/II BRILLIANCE study evaluating its lead candidate, EDIT-101, for the treatment of blindness due to LCA10. Currently, there is no therapy approved for treating LCA10.

The company plans to complete dosing in the pediatric mid-dose cohort of the BRILLIANCE study in the first half of 2022. Dosing in the pediatric high-dose cohort is expected to begin later in 2022.

An update from the BRILLIANCE study is expected in the second half of 2022.

This apart, Editas is evaluating the safety and efficacy of another pipeline candidate, EDIT-301, for treating sickle cell disease (“SCD”).

The company is currently enrolling participants in the phase I/II RUBY study for treating SCD and expects to begin dosing in the first half of 2022. Top-line data from the same is expected by 2022-end.

In April 2022, the FDA granted Rare Pediatric Disease designation to EDIT-301, an investigational gene-edited medicine for the treatment of transfusion-dependent beta thalassemia (“TDT”).

Editas plans to begin a phase I/II study to evaluate the safety, tolerability and preliminary efficacy of EDIT-301 for treating TDT patients. Dosing in the study is expected to begin later in 2022.

Zacks Rank & Stocks to Consider

Editas currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Aligos Therapeutics, Inc.

ALGS

,

Vertex Pharmaceuticals Incorporated

VRTX

and

Voyager Therapeutics, Inc.

VYGR

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Aligos Therapeutics’ loss per share has narrowed 14.3% for 2022 and 43.7% for 2023 over the past 60 days.

Earnings of ALGS surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Vertex’s earnings estimates have been revised 0.3% upward for 2022 and 0.2% upward for 2023 over the past 60 days. The VRTX stock has rallied 22.5% year to date.

Earnings of Vertex surpassed estimates in each of the trailing four quarters.

Voyager Therapeutics’ loss per share estimates have narrowed 38.6% for 2022 and 29% for 2023 over the past 60 days. The VYGR stock has skyrocketed 213.6% year to date.

Earnings of Voyager Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report