Editas Medicine, Inc.

EDIT

is scheduled to report second-quarter 2021 results on Aug 4, before market opens.

The company’s earnings history has been mixed so far, with its earnings beating estimates in two of the trailing four quarters and missing the same on the other two occasions, delivering an earnings surprise of 32.33%, on average. In the last-reported quarter, Editas reported a negative earnings surprise of 13.16%.

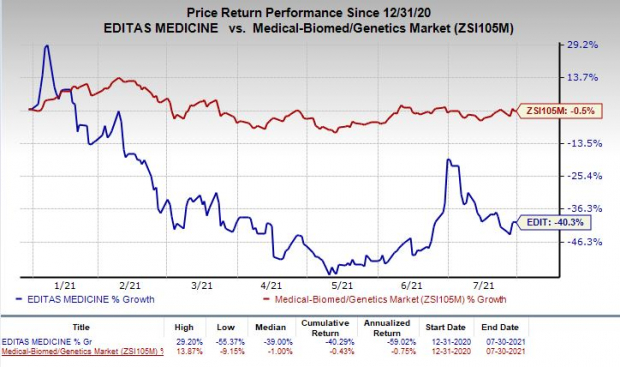

Shares of Editas have plunged 40.3% so far this year compared with the

industry

’s decrease of 0.5%.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the quarter to be reported.

Factors at Play

With no approved product in its portfolio at the moment, pipeline development remains the key focus for Editas. The company’s top line mainly comprises of collaboration revenues and other research and development revenues. In the last-reported quarter, Editas’ revenues increased year over year, a trend most likely to have continued in the to-be-reported quarter.

The company is developing its lead pipeline candidate, EDIT-101, which employs CRISPR gene editing to treat Leber congenital amaurosis type 10 (LCA10) — a rare genetic illness that causes blindness. In June 2021, Editas

started

enrollment in the first of two planned pediatric cohorts in the phase I/II BRILLIANCE study evaluating EDIT-101 for treating LCA10.

Editas will now run the pediatric mid-dose cohort and the adult high-dose cohort concurrently, with first dosing expected this summer and dosing completion anticipated in the first half of 2022. We expect management to provide more updates on the candidate’s progress at the upcoming earnings call.

Last August, Editas terminated its agreement with Allergan [now part of

AbbVie

ABBV

] and regained the full global rights to develop and commercialize its ocular medicines, including EDIT-101.

Editas has also commenced the phase I/II RUBY study to assess the safety and efficacy of another pipeline candidate, EDIT-301, for treating sickle cell disease. The company plans to dose the first patient in the RUBY study by the end of 2021. Investors will be keen to get more updates on the same at the upcoming earnings call.

The activities related to the development of EDIT-101 and other pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Editas this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Editas’ Earnings ESP is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 85 cents per share.

Zacks Rank:

Editas currently carries a Zacks Rank #3. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Stocks to Consider

Here are a few stocks you may want to consider, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle:

Sarepta Therapeutics, Inc.

SRPT

has an Earnings ESP of +25.10% and carries a Zacks Rank #2 at present. The company is scheduled to report earnings on Aug 4.

Illumina, Inc.

ILMN

has an Earnings ESP of +2.36% and carries a Zacks Rank #2 at present. The company is scheduled to report earnings on Aug 5.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report