Shares of

Emergent BioSolutions Inc.

EBS

were down 4.5% on Jun 6, following reports of

Johnson & Johnson

’s

JNJ

decision to terminate its contract with the company to develop its COVID-19 vaccine.

Per a Reuters

article

, J&J had informed Emergent almost a week ago about its intention to end the pact, citing contract breaches, which included failure to supply the COVID-19 vaccine drug substance.

Emergent also sent a notice to J&J alleging that the pharma giant breached the contract agreements in reply to J&J’s claims. Emergent stated that J&J failed to provide information on the requisite quantity of the product that the latter needed to purchase. Emergent sent a notice with the aforementioned claim and the notice also seeks confirmation from J&J about its intent to wind down the agreement instead of purchasing the requisite minimum quantity of the product pursuant to the agreement.

J&J and Emergent entered into an agreement to provide contract development and manufacturing (CDMO) services for J&J’s single-shot, adenovirus-based COVID-19 vaccine for five years. Per the SEC filing made by Emergent on Jun 6, the original agreement was valued at $480 million for two years of services, at the time of inking the deal. Emergent claimed that J&J would owe it approximately $125 million to $420 million, if the deal is terminated.

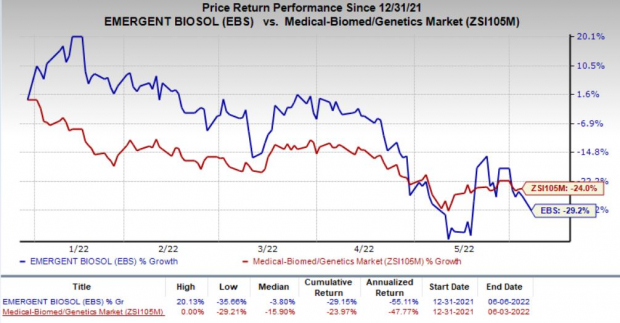

Emergent’s stock has declined 29.2% this year so far compared with a decrease of 24% for the

industry

.

Image Source: Zacks Investment Research

Although both companies are blaming each other for the termination of the deal, it remains to be seen how they sort it out. There will be likely reasons to support each company’s claims.

In April 2021, Emergent had to pause manufacturing at its Baltimore Bayview facility at the request of the FDA as millions of doses of J&J’s COVID-19 vaccine were ruined. Reportedly, workers at Emergent BioSolutions’ Bayview facility had mixed up vaccine ingredients of J&J’s and

AstraZeneca

’s

AZN

COVID-19 vaccines. This delayed the beginning of production of J&J’s COVID-19 vaccine by almost five months.

Emergent had signed a deal with AstraZeneca for providing CDMO services for the latter’s adenovirus-based COVID-19 vaccine. Following the event, the facility also stopped manufacturing AstraZeneca’s vaccine.

Meanwhile on its first-quarter earnings call, J&J withdrew its guidance for COVID-19 vaccine sales, citing global surplus supply and demand uncertainty. Moreover, the use of J&J’s vaccine was significantly restricted in the United States in May due to safety concerns.

The demand concerns amid uncertain COVID-19 infection cases are likely to impact sales of all authorized/approved COVID-9 vaccines, which may lead vaccine manufacturers to initiate cost-saving initiatives.

Zacks Rank & Stock to Consider

Emergent currently has a Zacks Rank #5 (Strong Sell).

Alkermes

ALKS

is a better-ranked biotech, carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Alkermes’ 2022 loss per share has narrowed from 14 cents to 3 cents in the past 60 days. Shares of ALKS have risen 21.8% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.48%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report