Emerson Electric Co.

EMR

is set to release first-quarter fiscal 2022 (ended December 2021) results on Feb 2, before market open.

The company’s earnings beat estimates in each of the last four quarters, the surprise being 10.69%, on average. In the last reported quarter, Emerson’s earnings of $1.21 per share beat the Zacks Consensus Estimate of $1.19 by 1.68%.

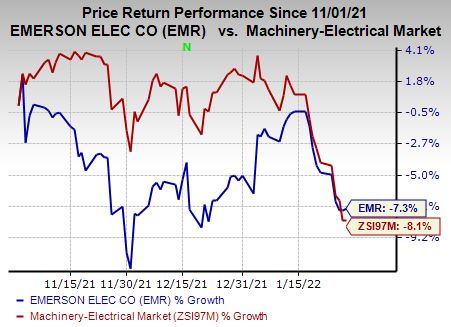

Image Source: Zacks Investment Research

In the past three months, the company’s shares have lost 7.3% compared with the

industry

’s decline of 8.1%.

Factors at Play

Emerson is expected to have benefited from strength across its cold chain, food and beverage, residential heating, ventilation and air conditioning end markets in first-quarter fiscal 2022. Also, improvements in process automation end market, coupled with the company’s robust backlog level at Automation Solutions and Commercial & Residential Solutions segments, are likely to have acted as tailwinds in the to-be-reported quarter.

Acquisitions made by the company positively impacted its revenues by 1% in fourth-quarter fiscal 2021 (ended September 2021), a trend which is likely to have continued in the to-be-reported quarter as well, given the strength across its acquired businesses. Emerson’s acquisition of Mita-Teknik (December 2021) has been expanding its presence in the renewable energy market. It acquired Progea Group and Open Systems International in the first quarter of fiscal 2021 (ended December 2020). While the Progea acquisition has enhanced the company’s offerings within control and embedded software space, the Open Systems buyout has boosted its offerings under the Automation Solutions segment.

Emerson’s focus on operational execution, along with investments in product innovation and digital initiatives, is likely to have supported its fiscal first-quarter performance.

However, over time, the escalating cost of sales and operating expenses have been a concern for Emerson. In fourth-quarter fiscal 2021, its cost of sales increased 10.3% year over year, while selling and administrative expenses jumped 11.4%. It has been witnessing supply-chain challenges and an increase in raw material costs. High costs and expenses might have adversely impacted its margin and profitability in the to-be-reported quarter.

Given Emerson’s extensive regional presence, its operations are subject to global economic, political risks and forex woes. A stronger U.S. dollar might have hurt the company’s overseas business in the fiscal first quarter.

The Zacks Consensus Estimate for Automation Solutions’ revenues for the fiscal first quarter is currently pegged at $2,861 million, indicating a 10% decline from the quarter-ago reported number. The consensus estimate for revenues from the Commercial and Residential Solutions segment is pegged at $1,606 million, indicating a sequential decrease of 9.5%.

The Zacks Consensus Estimate for the company’s fiscal first-quarter total revenues is currently pegged at $4,470 million, suggesting 7.4% growth from the year-ago figure but a 9.6% decline from the quarter-ago reported number. The consensus estimate for earnings of 99 cents suggests an improvement of 19.3% year over year and a fall of 18.2% sequentially.

Earnings Whispers

According to our quantitative model, a stock needs to have the combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy), or at least 3 (Hold) to increase the odds of an earnings beat. But that is not the case here, as we will see below.

You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP

: Emerson has an Earnings ESP of -1.18%, as the Most Accurate Estimate is pegged at 98 cents, lower than the Zacks Consensus Estimate of 99 cents.

Zacks Rank

: The company carries a Zacks Rank #3.

Key Picks

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

Illinois Tool Works Inc.

ITW

has an Earnings ESP of +0.22% and a Zacks Rank #3 at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Illinois Tool’s earnings is pegged at $1.89 per share for the fourth quarter of 2021. ITW’s shares have gained 1.3% in the past three months.

Expedia Group, Inc.

EXPE

has an Earnings ESP of +4.64% and a Zacks Rank of 3, currently.

The Zacks Consensus Estimate for Expedia’s earnings is pegged at 97 cents per share for the fourth quarter of 2021. EXPE’s shares have gained 4.2% in the past three months.

Flowserve Corporation

FLS

has an Earnings ESP of +2.08% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Flowserve’s earnings is pegged at 48 cents per share for the fourth quarter of 2021. FLS’ shares have lost 3.6% in the past three months.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report