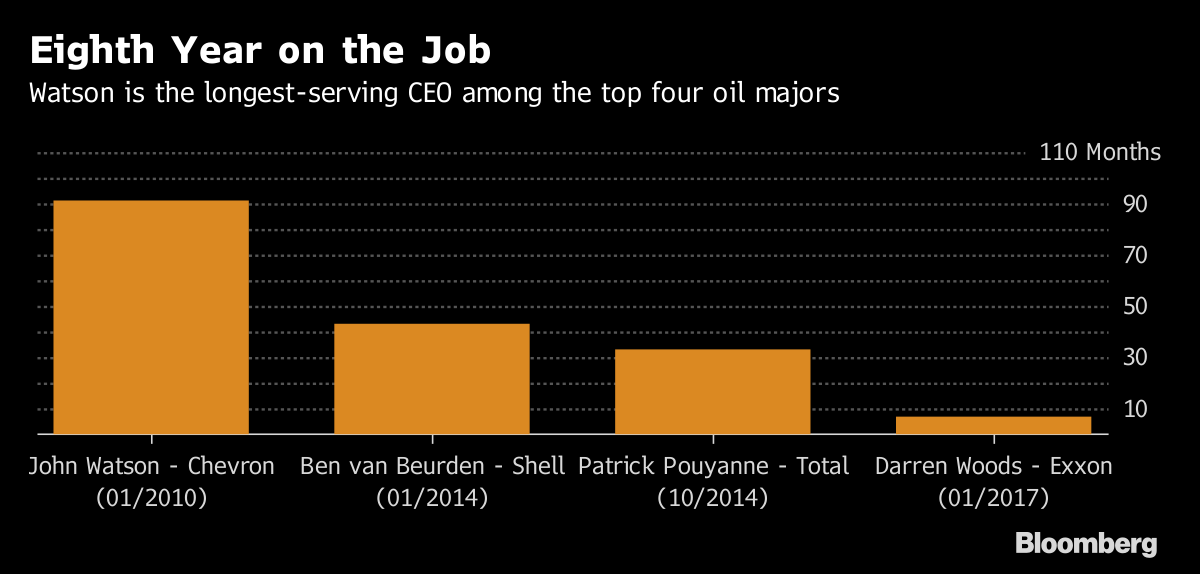

On Tuesday, August 22nd, Chevron’s (NYSE:$CVX) CEO John Watson announced that he is planning to step down from his position, the Wall Street Journal reported, according to those familiar with the current situation. Watson will be leaving the oil and gas giant after about 7 years of leading the company. While the company has yet to finalize who Watson will pass the torch to, many have speculated that Michael Wirth – a life-long Chevron employee who had been named vice chairman earlier this year – will be taking on the CEO position once Watson leaves. Watson’s potential replacement, Wirth, looks like he could lead the company well. Wirth had been largely responsible for restructuring Chevron’s oil business. Wirth then also helped the company stop producing crude oil in Western Europe and put more focus in East Asia and Latin America.

An official announcement from Chevron themselves will most likely be made some time next month, the Wall Street Journal said. When reached out to for comment, Kent Robertson, one of Chevron’s spokespersons, declined.

Watson became CEO after managing Chevron’s acquisition of Texaco Inc. and Unocal Corp. that had been set in motion by then-CEO David O’Reilly. Watson had done well in leading Chevron past several hurdles – in 2014, Watson had trouble protecting the company’s dividend payouts in the face of falling oil prices and smaller cash flow. As the oil industry continued to struggle, Watson had to cut jobs, cancel projects, and sell billions of dollars worth of company assets in order to keep Chevron from tumbling too far in the wake of weak oil prices. Despite his best efforts, however, Chevron saw a drop of $50 billion in market value and, in 2016, released its first annual loss in almost 37 years. Still, it can be definitely argued that without Watson’s leadership, Chevron could have been privy to much bigger losses.

At 60, Watson will be retiring a bit before the Chevron-mandated retirement age of 65 years old. According to Bloomberg, Watson could be leaving the company with a retirement package worth as much as $119.3 million. The package could include $45.5 million worth of pension benefits, $13.4 million in deferred compensation, and $60.3 million in equity grants. All of Watson’s options and restricted stock can be vested if he’d had the options/stock for at least one year. As such, if the CEO leaves before January 25, 2018, he will have to give up the currently $3.46 million worth of options and restricted stock he currently holds. Chevron will also be giving Watson about $200.000 annually as office and administrative support.

Featured Image: twitter