Conversations between BHP Billiton Limited (NYSE:$BHP) and American hedge fund management firm Elliott Management were revealed earlier this year. Elliott Management wants BHP to make changes to its company, believing that these changes will be able to raise shareholder value. The hedge fund management firm had been successful in pushing other companies — such as metal engineering company Arconic (NYSE:$ARNC) — to make changes, prompting investors to question what will come about BHP Billiton if they were to implement the changes suggested by Elliott.

What Elliot has Demanded

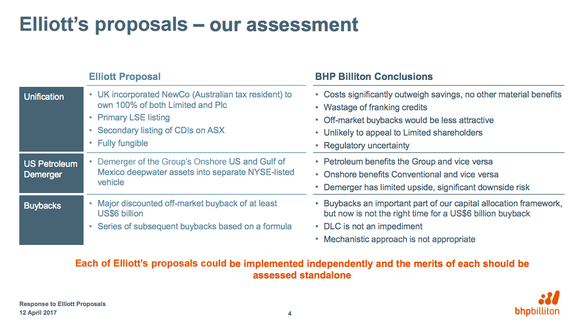

Elliott has proposed three main changes that BHP implement in order for BHP to simplify the corporate structure of the company. To do so, Elliott has asked BHP to make changes to its dual shares, buy back around $6 billion of its shares, and move away from the company’s oil business. But BHP has disagreed to all of Elliott’s requests, arguing that the company’s corporate structure doesn’t hurt its business, that it was not the time to buy back its shares, and that the oil business has been good for the company overall.

However, many wonder how long BHP will be able to fight against Elliott’s requests, as the fund management firm’s track record has been quite notable. In its recent push for Arconic to implement changes, Klause Kleinfield, Arconic’s CEO, ended up leaving the company. Both Elliott and Arconic came to agreements regarding the board, so a disputed shareholder vote was not needed.

Besides Arconic, Elliott also proposed changes to giant tech company Samsung — wanting its business to be restructured into a holding company.

In the end, Elliott did not get Samsung to restructure completely — but Samsung did end up cancelling treasury shares and to begin dividend payments under Elliott’s requests for change.

Not Going to Happen

BHP’s argument for not wanting to change the corporate structure can be quite justified. Making such changes will require a lot of time, difficulties, and regulatory approvals. As such, if the corporate structure is not damaging the company significantly in any way, changing it can be seen as unnecessary and a waste of time.

When it comes to buying back shares, BHP refusal can also be justified. Although buying back the shares will only cost about 40% of the cash on BHP’s balance sheet — hardly enough to create a dent — BHP has insisted that it would rather have some flexibility when it comes to its balance sheet right now. Either way, buying back its shares or not, it shouldn’t cause any lasting changes to the company or its stocks.

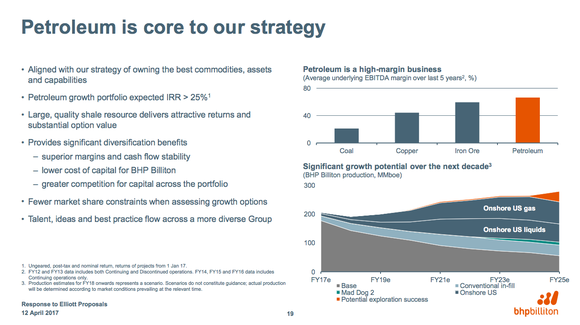

The biggest request for change is for BHP to drop its oil business. Unlike the first two requests — which BHP has had good reasons to refuse — Elliott seems to have the upper hand on this decision. While BHP has argued that the company’s geology knowledge provides an advantage in the oil business, drilling for oil is quite different than mining for metals such as iron ore, copper, and/or metallurgical coal. That being said, many of those in energy investments is concerned about BHP’s standing against oil giants such as ExxonMobil (NYSE:$XOM).

However, it can also be argued that BHP’s oil business gives it an upper-hand from its fellow energy competitors such as Rio Tinto plc (LON:$RIO) and Vale SA (BVMF:$VALE5) who doesn’t drill for oil. While it may not stand against some giants in the oil industry, the commodity remains a big business for BHP. BHP’s oil business was responsible for about 20% of the company’s underlying earnings before interest, taxes, depreciation, and amortization (EBITDA). Furthermore, BHP’s oil business’ average EBITDA over the past five years was higher than all of the company’s mining businesses — noting to BHP that it should stick to the business and continue to grow it.

Perhaps Some Sort of Compromise?

BHP’s oil business, while having been quite profitable for the company, cannot be argued strongly to have been the perfect investment. BHP announced early last year that the company had written down the value of its U.S. shale oil assets to be around $7 billion — bringing the total to be around $13 billion on about the $20 billion in investments in the U.S. shale space.

However, shale oil is only a small part in BHP’s oil portfolio, and the company has been searching for something different to aid in the U.S. shale operations. It seems as if BHP will be willing to give up on the U.S. shale business if Elliott continues to push for changes. The move would be made in hopes that Elliott will be satisfied enough to back off, and BHP would not have to drop the entirety of its oil business.

Timing is Slightly Off

Discussions between Elliott and BHP will probably remain just that for now — any changes to be made is to be seen in the far future. This should be good news for those in energy investments, after all BHP has just went through quite a change when it gave up several assets to South32 (ASX:$S32) in 2015. With only 2 years since its last makeover, there really hasn’t been enough time to evaluate properly whether or not BHP’s new businesses are working. Commodities has only recently begun to move in a positive direction — oil, in particular, has risen from $30 a barrel to about $50 a barrel.

It is important to take note that BHP’s oil assets shouldn’t be leaving any time soon — and that BHP could easily spin off the business at a later date just as easily as it could spin off the business today. BHP’s wait and planned growth for its oil business is looking like a more low-risk and safer thing to do. As such, BHP may be able to defend itself fiercely again Elliott.

Featured Image: twitter/Getty Images