Following movements in crude oil and natural gas prices, shares of Chesapeake Energy (NYSE:$CHK) saw some improvement last week. It is highly suggested that those who invest in energy and companies like Chesapeake Energy keep an eye on crude oil and whether natural gas prices can keep up with its positive increase last week.

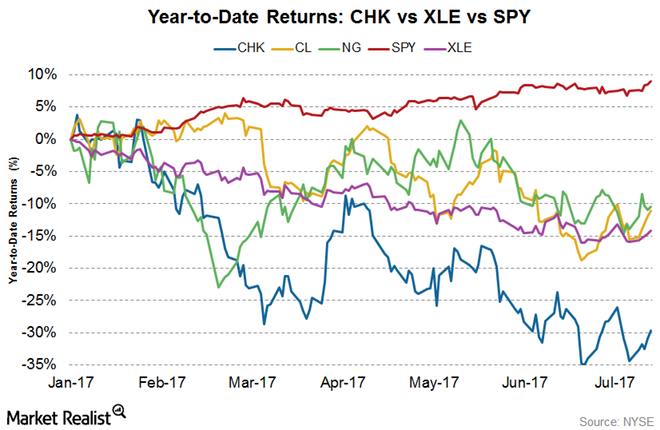

So far this year, Chesapeake’s stock has decreased by about 30% — a significant fall when compared to the falls in the prices of crude oil and natural gas. Crude oil prices have decreased about 11% overall so far in 2017, while natural gas prices have fallen by about 10.4%.

Comparing Chesapeake with the rest of the energy sector, represented by the Energy Select Sector SPDR ETF (NYSEARCA:$XLE), the company has underperformed this year. The Energy Select Sector SPDR ETF have only fallen by about 14% so far this year — less than half of Chesapeake’s fall.

Looking at the bigger picture, the energy sector has been underperforming overall in the broader market — for example, the SPDR S&P 500 ETF (NYSEARCA:$SPY) has been rising since the beginning of this year while the Energy Select Sector SPDR ETF fell.

What investors think

More conservative investors may want to sit out on this one, given the volatility in energy prices recently. The movement in price is especially concerning when one considers the fact that Chesapeake is looking to increase its spendings this year while still struggling with a debt load of $9 billion (as of the end of 2017’s first quarter). The company will need enough cash flow to cover the spendings, and investors should keep an eye out in case Chesapeake gets in more debt by taking out loans to fund its spendings.

That said, however, Chesapeake did have about $249 million in cash and cash equivalents according its 2017 first quarter reports. The company is also making the reduction of its debt one of its top priorities. This can be seen through efforts in debt exchanges, open-market repurchases, equity-for-debt exchanges, and asset sales.

Chesapeake also announced in late May of this year that it’ll be issuing around $750 million additional notes in a private placement, with plans to use the proceeds from this endeavour towards tender offers, debt repayment, and other general corporate purposes. Chesapeake revealed that it will be redeeming 2.8% of contingent convertible notes on June 22. The notes are due in 2035.

Chesapeake’s implied volatility

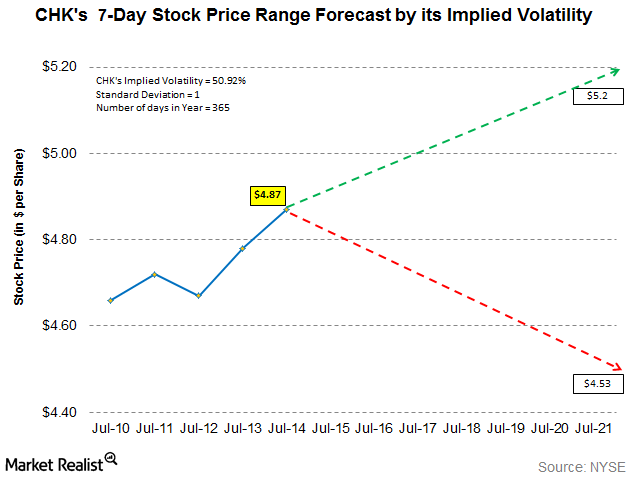

As of July 17, 2017, Chesapeake Energy had an implied volatility of around 51%. This is much higher than other similar companies’ implied volatilities. Noble Energy’s (NYSE:$NBL) implied volatility is 36.5% while Cabot Oil & Gas has an (NYSE:$COG) implied volatility of around 32%.

The implied volatility can help analysts and traders estimate the price range of a certain company’s stock for the next week. Looking at Chesapeake’s implied volatility, analysts believe that the company’s stock could range between $4.53 and $5.20 for the next seven days, assuming there is a normal price distribution and a standard deviation of one.

Analysts’ ratings

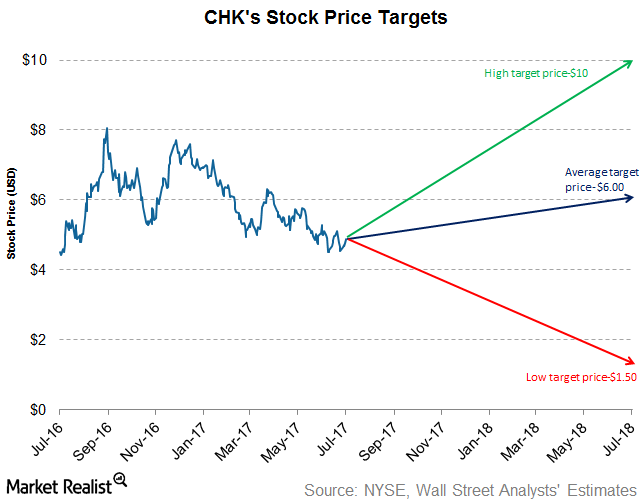

About 65% of Wall Street analysts who have covered Chesapeake have given the company a rating of “hold”. On average, analysts have given Chesapeake a target price of around $6.00.

During the beginning of 2017, Bank of America Merrill Lynch (NYSE:$BAC) lowered its rating on Chesapeake’s stock from “neutral” to “underperform”, while UBS (NYSE:$OUBS) upgraded its rating from “sell” to “neutral”. Macquarie (ASX:$MQG) most recently downgraded its rating of Chesapeake from “neutral” to “underperform” on June 21.

Analysts’ earnings expectations

For the second quarter of 2017, analysts are expecting an average of $0.15 for Chesapeake’s earnings per share (EPS), with a high estimate of $0.22 per share and a low estimate of $0.08 per share.

Chesapeake’s revenue is estimated to be an average of around $2.3 billion based on analyst expectations, with a high estimate of around $2.5 billion and a low revenue estimate of around $2 billion.

Featured Image: twitter