Although there are many disadvantages to nuclear power — like the danger of radiation from nuclear accidents and massive cleanups if spills ever occurred, as illustrated through disasters such as Three Mile Island in 1979, Chernobyl in 1986, and Fukushima in 2011– demand for nuclear power have remained steady. As such, uranium, a key element to providing nuclear power, have become a commodity that investors are taking interest in.

Why is it smart to invest in uranium?

It is predicted that, along with a handful of emerging countries, India and China will make up about 70% of the future growth in global energy demand. A uranium investment is beneficial in the long run right now because India and China will not be able to keep up with its power needs without the use of nuclear energy.

While using coal as a source of energy is an option — the material is cheap and abundant — it can only add on to the serious pollution problems that plague both India and China. Thus, a cleaner source of energy needs to be considered. Out of options such as solar or wind power, nuclear energy is more reliable, cost efficient, and proficient than most sustainable energies. This makes nuclear energy the logical choice when it comes to finding a power source that meets the needs of highly-populated countries like India and China.

If you wish to get into uranium investing, it is highly recommended that you do it through the Global X Uranium ETF. The exchange-traded fund tracks an index of active companies in the uranium industry.

China & India – the future for nuclear energy

As previously mentioned, China and India will need nuclear energy in order to meet their power needs. Already, the planning and implementation of several nuclear reactors and power plants are in motion.

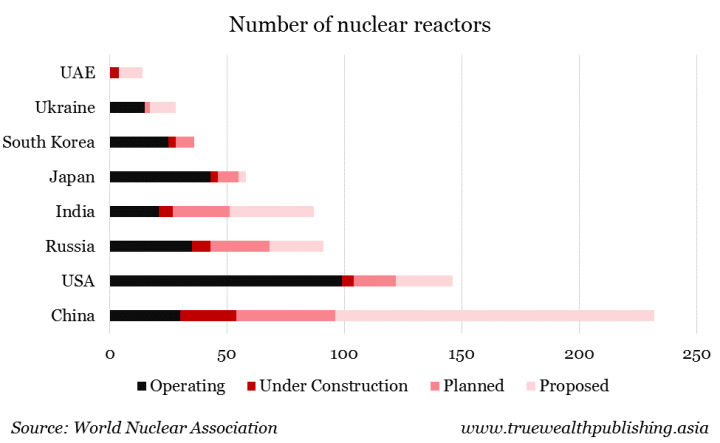

According to the World Nuclear Association, China is currently in the process of building 21 nuclear reactors, adding on to its 36 reactors currently in operation. As well, additional reactors are in planning stages, some using the most advanced technologies. With this, China hopes to produce three times its current nuclear power by 2021, and by 2030 have 8-10% of its power needs supplied using nuclear power, compared to the current 2%. As such, China is looking like a good candidate for long-term investors who want to invest in uranium.

Similar to China, India is building more reactors: six are currently under construction, with 21 reactors already operation and 60 reactors planned. By 2050, India hopes to have 25% of its electricity be supplied by nuclear power, compared to the current 3.5%. Like China, long-term uranium investment in India is ideal.

Make sure you keep up with the news, however, as it remains to be seen if the planned and proposed plants will actually undergo construction. Nonetheless, those that want to invest in uranium should give these countries a chance as there is a clear intention and effort to increase the role nuclear power plays in supplying energy.

Uranium supply and demand

In the long run, things look good for investors who want to invest in uranium or already in uranium investing. Currently, according to the World Nuclear Association, the annual global demand for uranium is 66,000 tons. By 2035, it is predicted that this number will grow to 103,000 tons.

To have enough uranium to meet the rising demand, uranium production will need to double over the next 20 years. If demand is somehow not met, there are also other sources such as disarmed nuclear weapons, stockpiles, and recycled uranium that can help make up the gaps between production and demand.

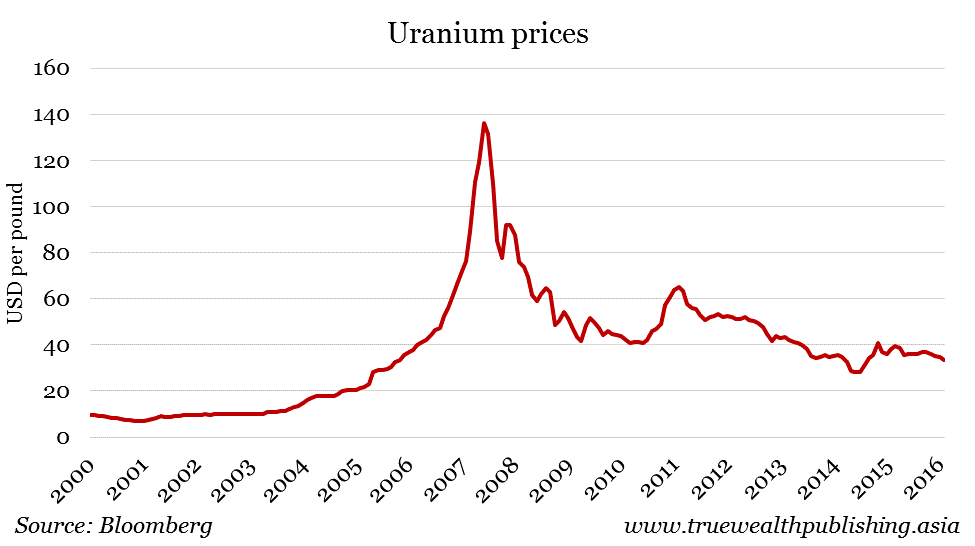

Although uranium currently cost around $30 per pound — with the break-even price at $50 per pound for existing mines and $70-80 per pound for new mines — the price is expected to rise. This is due to the fact that in 2007, prices fell instead of rose after an abundance of mining companies agreed to 10-year supply deals.

Now, uranium prices will need to rise in order to build new mines and increase production at existing ones. As well, many 10-year supply contracts will be expiring, and since uranium prices are too low to match the demand, nuclear power companies are expected to pay more for each pound of uranium.

With increasing uranium demand from China and India and supply that is trying to catch up along with re-negotiations of several contracts, it is predicted that uranium prices will flourish. Thus, it could be profitable to invest in uranium right now or look into a couple of uranium investment options.

Featured Image: depositphotos/kalinovsky