Enphase Energy, Inc.

ENPH

recently revealed that its solar installers in Oregon are witnessing higher deployments of the Enphase Energy System. This should further boost Enphase’s revenues from the United States in 2022, with the solar player having recorded a solid 74% year-over-year U.S. revenue growth last year.

Oregon homeowners can now install Enphase’s revolutionary IQ8 Microinverters, which provide an impressive backup system during an outage, even in absence of a battery.

What’s Boosting Deployments in Oregon?

Extreme weather conditions across the United States have disrupted electric grids several times lately, leading to increased homeowner interest in solar and battery systems. Being no exception, Oregon has also been experiencing similar trends, which must have boosted the demand for energy storage systems like Enphase Energy System. The system is a complete solar solution, comprising the company’s IQ Microinverters and IQ Batteries.

Enphase’s Prospects in Oregon

Last July, Oregon became the eighth U.S. state to enact a renewable energy commitment into law after the state’s governor, Kate Brown, signed a bill mandating utilities and energy providers to provide customers with 100% clean electricity by 2040. Surely this boosts the prospect of solar players like Enphase Energy in Oregon.

As multifaceted impacts of global warming are projected to create more frequent irregularities in weather patter around the world, energy storage demand in Oregon can be expected to increase manifold in the coming years.

Per the U.S. Energy Storage Monitor report from the Energy Storage Association and Wood Mackenzie, the deployment of residential storage capacity in Oregon is anticipated to grow five times by 2026. Such forecast exemplifies immense growth opportunities for ENPH to prosper on the growing demand with its best-in-class battery storage systems and customer experience.

U.S. Battery Storage Boom

The United States’ zero-emission target is pushing the adoption of various renewable sources of energy. Underpinned by growth in renewable sources of energy, the battery storage system is also gaining momentum as it reduces dependence on the grid and supports its proper functioning.

Per the U.S. Energy Information Administration, the United States is likely to register the installation of an additional 10,000 megawatts of large-scale battery storage projects between 2021 and 2023.

Such growth projections related to the U.S. battery storage market embody ample opportunities for companies like Enphase Energy to flourish on the growing trend. Prominent solar players like

SolarEdge Technologies

SEDG

,

SunRun

RUN

and

SunPower

SPWR

have also capitalized on the bright prospects of the U.S. battery storage market with their product range.

For instance, SolarEdge’s StorEdge battery storage system helps meet energy demands with less or cheaper electricity. The company strengthened its presence in the United States by launching its SolarEdge Energy Bank residential battery and SolarEdge Energy Hub inverter with enhanced backup power in October 2021.

The long-term earnings growth rate of SolarEdge stands at 21.5%. The Zacks Consensus Estimate for SEDG’s 2022 earnings entails an improvement of 43.9% from the prior year’s estimated figure. Shares of SolarEdge have returned 17.7% to its investors in the past year.

SunRun’s Bright Box battery storage system offers the flexibility to generate, store and manage clean, affordable solar energy. Brightbox can buffer homeowners from increasing energy costs so that they have power when they need it the most, enabling homeowners to take charge of their electric bills and get control of energy needs now and in the future.

The Zacks Consensus Estimate for RUN’s 2022 sales indicates an improvement of 8.9% over the prior year’s reported figure. Its first-quarter 2022 earnings estimate reflects an increase of 63.6% from the prior-year quarter’s reported figure.

SunPower’s Equinox system with SunVault Storage solution offers an effective storage solution to homeowners by collecting excess energy in the daytime and distributing it as needed to power essential devices during an outage. The company recently signed a deal, as part of which its Equinox home solar system will be deployed at all new houses built by Landsea in California. Homebuyers in Arizona, Florida and Texas will also have the option to add the technology to their properties.

The Zacks Consensus Estimate for SunPower’s 2022 earnings suggests an improvement of 457.1% in the past year’s reported number. The long-term earnings growth rate for SPWR stands at 15.6%.

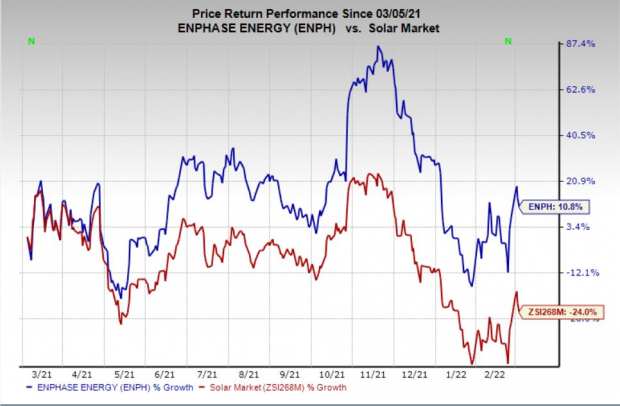

Price Movement

In the past year, shares of Enphase Energy have increased 10.8% against the

industry

’s 24% decline.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report