Enphase Energy, Inc.

ENPH

recently announced that the demand for its Enphase Energy System, powered by IQ Microinverters and IQ Batteries, has escalated in Puerto Rico as homeowners hunt for a reliable and clean energy source amid rising grid outages in the region. Also, the approaching hurricane season, when prolonged outages tend to become a daily phenomenon, sparked the demand for Enphase’s state-of-the-art energy system.

Additionally, rising energy prices are also fueling the demand for a resilient storage system. In such a scenario, Enphase’s technologically advanced products, which are claimed to be the industry’s smartest, tend to gain traction. This entails ENPH’s continuous focus on strategically growing the business by tapping the market, which boasts significant demand strength.

What’s Driving Demand for Enphase Products in U.S.?

The demand for Enphase products is increasingly intensifying in the United States as the company strives to provide the best-in-class products to meet the ever-changing needs of the evolving solar market.

Before the improved demand was witnessed in Puerto Rico, Enphase witnessed the increased deployment of its products in Southern California and Florida.

With many regions in the United States approaching the hurricane season, when the grid fails to function 24×7 due to lashing winds and torrential rainstorms, the demand for Enphase’s products is likely to increase manifold as it endeavors to offer industry-leading home solar and battery systems with greater resilience for energy independence.

Moreover, Enphase’s increased focus to capitalize on the amplified demand going forward can be gauged from its effort to add an automated line at Flex’s factory in Romania, which boasts a quarterly capacity of roughly 750,000 microinverters starting in the first quarter of 2023 and will enable a global capacity of nearly six million microinverters per quarter.

Such capacity maximization should boost the stock’s shipment count further and assist the company in meeting the growing solar demand, thereby bolstering its future revenues.

U.S. Battery Storage Market Boom

The rapid expansion of the U.S. solar market is likely to trigger the growth of the battery storage market as well since solar energy fails to provide electricity 24×7. In the next two years, power plant developers and operators are likely to add 10 gigawatts of battery storage capacity, of which more than 60% will be linked with solar services, per the latest short-term energy outlook report from the U.S. Energy Information Administration.

Such growth projections for the U.S. battery storage market stand to benefit the leading solar behemoths in the industry. Against this backdrop, solar companies that stand to gain from the expanding battery storage market are

SunPower

SPWR

,

SunRun

RUN

and

SolarEdge Technologies

SEDG

.

In March 2022, SunPower announced that its residential battery storage system, SunVault Storage, with 26-kilowatt hour (kWh) and 52 kWh configurations, is now capable of providing whole-home backup services for customers without sacrificing essentials or comfort during an outage. The installation of the new SunVault will begin in June 2022.

The Zacks Consensus Estimate for SunPower’s 2022 earnings suggests a growth rate of a solid 414.3% from the prior-year period. Shares of SPWR have rallied 9.4% in the past month.

SunRun’s Brightbox provides uninterrupted backup power for the entire home. It also excels in providing electricity during peak demand times, thus buffering customers from high rates.

The Zacks Consensus Estimate for SunRun’s 2022 sales indicates a growth rate of 19.6% from the prior-year reported figure. RUN shares have rallied 6.3% in the past month.

SolarEdge launched its residential battery, the SolarEdge energy bank, in 2021. This is a 10-kilowatt single-phase battery that integrates with its SolarEdge energy hub family of inverters. Some of the existing SolarEdge systems can be upgraded with a storage solution for backup or on-grid maximum self-consumption use.

SolarEdge boasts a long-term earnings growth rate of 28.5%. SEDG shares have appreciated 4.2% in the past year.

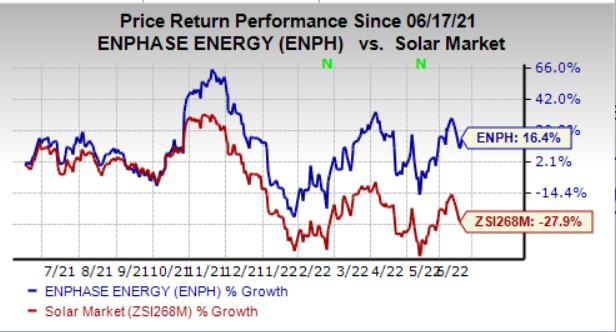

Price Performance

In the past year, shares of Enphase have risen16.4% against the

industry

’s decline of 27.9%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report