Enphase Energy, Inc.

ENPH

recently revealed that Missouri is witnessing the increased adoption of the Enphase Energy System, powered by IQ Microinverters and IQ Batteries. Such increased demand for a clean reliable storage solution among homeowners is driven by extreme weather conditions.

Missouri homeowners’ adoption of Enphase’s revolutionary IQ8 Microinverters highlights the growing importance of its latest launch and an opportunity to boost its revenue generation prospects.

Enphase Energy’s Growth Prospects in Missouri

To meet clean energy and decarbonization goals, Missouri is increasingly taking measures to encourage the development of solar projects. In this context, it is imperative to mention that apart from the federal Investment Tax Credit, Missouri offers additional incentives and rebates for solar installations as well as solar property tax exemption.

This undoubtedly highlights the growing importance of solar-based energy in the region and subsequently the abounding opportunities for the battery storage market.

Moreover, per the U.S. Energy Storage Monitor report from the Energy Storage Association and Wood Mackenzie, the residential battery capacity in Missouri is projected to witness nearly 14-fold growth by the end of 2026.

Such a solid growth projection boasts tremendous opportunitiesfor solar companies like Enphase Energy to further expand in the market with innovative products.

U.S. Battery Storage Market Boom

Energy storage offers more flexibility and resilience for a grid to function more efficiently and effectively. To this end, the U.S battery storage market is likely to increase manifold as the nation increasingly penetrates the solar power energy market for energy needs.

Per the report from the U.S. Energy Information Administration, the United States may witness battery storage to increase by 10 gigawatts by the end of 2023.

Such upbeat prospects stand to benefit companies like ENPH to further solidify their presence in the market and strategically grow through their product offerings. Considering the boom in the battery solar market, several solar majors have started to foray into the lucrative battery solar market.

In November 2021,

SolarEdge Technologies, Inc.

SEDG

launched its residential battery, the SolarEdge energy bank. This is a 10-kilowatt single-phase battery that integrates with its SolarEdge energy hub family of inverters. Some of the existing SolarEdge systems can be upgraded with a storage solution for backup or on-grid maximum self-consumption use.

SolarEdge boasts a long-term earnings growth rate of 28.5%. The Zacks Consensus Estimate for SEDG’s 2023 earnings indicates a 38.9% improvement over the prior-year quarter’s reported figure.

In March 2022,

SunPower

SPWR

announced that its residential battery storage system, SunVault Storage, with 26-kilowatt hour (kWh) and 52 kWh configurations, is now capable of providing whole-home backup services for customers without sacrificing essentials or comfort during an outage. The installation of the new Sunvault will begin in June 2022.

The Zacks Consensus Estimate for SunPower’s 2023 earnings has been revised upward by 30.2% in the past 60 days.

SunRun

’s

RUN

Bright box provides uninterrupted backup power for the entire home. It also excels in providing electricity during peak demand times, thus buffering customers from high rates.

The Zacks Consensus Estimate for SunRun’s 2023 earnings indicates a growth rate of 1.7% from the prior-year reported figure.

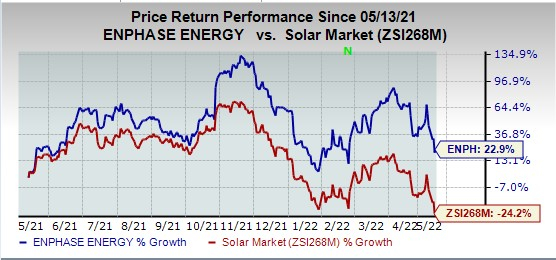

Price Movement

In the past year, shares of Enphase Energy have rallied 22.9% against the

industry

’s decline of 24.2%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report