Enphase Energy, Inc.

ENPH

recently revealed that it has recorded the increased adoption of its Enphase Energy System, comprising IQ Microinverters and IQ Batteries in Colorado. The increased deployment of IQ Microinverters and IQ Batteries exemplifies Enphase Energy’s ability to capitalize on the improving demand in the residential battery storage market.

What’s Favoring Enphase Energy’s Growth?

The increased adoption of Enphase Energy’s product offerings worldwide reflects its capabilities in offering the best standard and technologically advanced products to its customers. Also, Enphase Energy’s continuous efforts to improvise on its product offerings to provide homeowners with an excellent experience and improve customer reliability have resulted in huge demand for its products.

Additionally, extreme weather conditions resulting in prolonged power outages in some regions have propelled demand for an efficient battery storage system. In this context, it is imperative to mention that the recent surge in the deployment of its products in Colorado is supported by homeowners’ hunt for a reliable and durable alternative, which will lower dependence on the power grid. Battery storage and microinverters of ENPH will support customers’ electricity needs during the extreme winter days that bring extended power outages.

Colorado exemplifies massive growth potential for renewable sources of energy as the region enjoys sunny skies almost throughout the year, exhibiting immense opportunities for solar companies to develop solar projects and shine on the same.

This also adds impetus to the growth of the battery storage market in the region as it enables homeowners to store the energy when not in use. This, in turn, provides a huge growth platform for companies like Enphase Energy to prosper through its innovative products.

Moreover, per the U.S. Energy Storage Monitor report from the Energy Storage Association and Wood Mackenzie, Colorado may witness two times more deployments in 2022 in residential battery storage while boasting 12-fold growth rate momentum in deployments over the next six years.

Considering the solid growth prospects in the battery storage market in Colorado going forward, Enphase Energy may further witness the increased adoption of its products, which may boost its revenues from the Enphase Energy System line of business in the long haul.

U.S. Battery Storage Boom

The United States zero-emission target is impelling the adoption of various renewable sources of energy. Underpinned by growth in renewable sources of energy, the battery storage system is also gaining momentum as it reduces dependence on the grid and supports its proper functioning.

Per the U.S. Energy Information Administration, the United States is likely to witness an addition of 10,000 megawatts of large-scale battery storage projects to be installed between 2021 and 2023.

Such compelling growth projections of the U.S. battery storage market embody ample opportunities for companies like Enphase Energy to flourish on the growing trend. Prominent solar players like

SolarEdge Technologies

SEDG

,

SunRun

RUN

and

SunPower

SPWR

have also capitalized on the bright prospects of the U.S. battery storage market with their product range.

For instance, SolarEdge’s StorEdge battery storage system helps meet energy demands with less or cheaper electricity. The company recently strengthened its presence in the United States by launching its SolarEdge Energy Bank residential battery and SolarEdge Energy Hub inverter with enhanced backup power.

The long-term (three-five years) earnings growth rate of SolarEdge stands at 20.6%. The Zacks Consensus Estimate for SEDG’s 2022 sales entails an improvement of 35.6% over the prior-year estimated figure. Shares of SolarEdge have returned 8% to its investors in the past six months.

SunRun’s Bright Box battery storage system offers the flexibility to generate, store and manage clean, affordable solar energy. Brightbox can buffer homeowners from increasing energy costs so that they have power when they need it the most, thus enabling homeowners to take charge of their electric bills and get control of energy needs now and in the future.

In the last reported quarter, SunRun delivered an earnings surprise of 120.00%. The Zacks Consensus Estimate for RUN’s 2022 sales indicates an improvement of 13.1% over the prior-year estimated figure.

SunPower’s Equinox system with SunVault Storage solution offers an effective storage solution to homeowners by collecting excess energy in the daytime and distributing it as needed to power essential devices during an outage. This reduces reliance on grid electricity. This also reduces peak-time charges.

The Zacks Consensus Estimate for SunPower’s 2022 sales implies an upward revision of 4.4% in the past 60 days. The long-term earnings growth rate for SPWR stands at 15.6%.

Price Movement

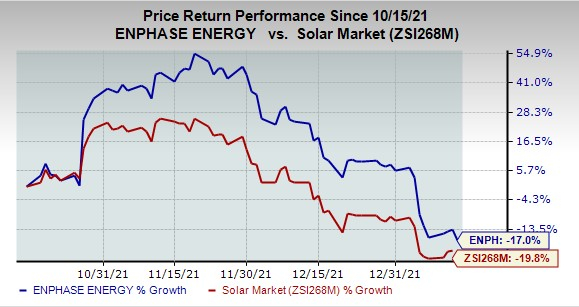

In the past three months, shares of Enphase Energy have decreased 17% compared with the

industry

’s 19.8% decline.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report